$BRK.A $BTC #WarrenBuffett #BerkshireHathaway #StockMarket #Bitcoin #Investing #Finance #EconomicIndicators #MarketTrends #CryptoCurrency #FinancialWisdom

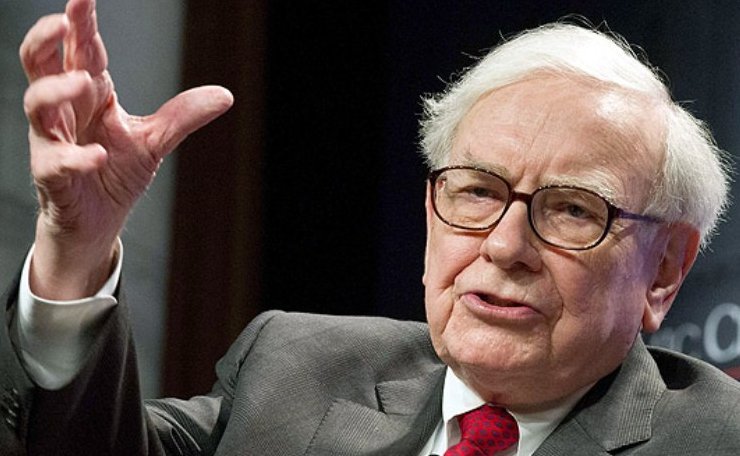

Is Warren Buffett’s Massive Cash Reserve a Warning for Stocks and Bitcoin Investors?

In the realm of investing, Warren Buffett’s strategies are often seen as a barometer for broader market sentiment. Recently, Berkshire Hathaway’s increasing cash reserves have raised eyebrows across both the stock and cryptocurrency sectors. This shift is significant, as Buffett is known for his strategic financial moves in times of market over-enthusiasm.

A Strategic Shift or Market Forewarning?

Berkshire Hathaway’s growing cash pile, now amounting to billions, seems to indicate a cautious approach. Historically, Buffett has opted to hold cash during times of market overvaluation, suggesting that current market conditions might be more volatile than they appear. This strategy aligns with the adage of being “fearful when others are greedy,” a principle that Buffett has championed throughout his career.

Implications for Stock and Crypto Markets

For investors in the stock market and digital currencies like Bitcoin, Buffett’s moves should not be ignored. The correlation between Buffett’s cash reserve strategies and preceding market downturns can’t be overlooked. As such, this could be a pivotal moment for investors to reevaluate their portfolios and risk exposure.

Understanding Market Cycles Through Buffett’s Eyes

Buffett’s approach provides a clear lesson on market cycles and investor psychology. By analyzing his investment patterns, one can gain insights into potential market corrections and the importance of liquidity during uncertain times. For more detailed analyses on similar topics, consider exploring investment strategies and market predictions.

What Can Crypto Investors Learn From Buffett?

While Buffett has traditionally been skeptical about cryptocurrencies, the underlying principle of his investment strategy — caution during market highs — is applicable to the crypto market as well. Crypto investors might find it prudent to consider the broader market signals implied by Buffett’s actions. For those looking deeper into cryptocurrency trends, a visit to cryptocurrency insights might provide valuable information.

Navigating Uncertainty: Strategies for Investors

In navigating these uncertain financial waters, investors might consider diversifying their portfolios or increasing their cash holdings as a buffer against potential market corrections. Additionally, keeping an eye on economic indicators and market sentiment can offer timely cues for strategic adjustments.

Conclusion: Is Caution the Key?

Warren Buffett’s growing cash reserve is a significant indicator in the financial landscape, hinting at potential caution in the face of widespread market optimism. Both stock and cryptocurrency markets could be at a turning point, and Buffett’s classic investment wisdom reminds us that sometimes, the best offense is a good defense.

For those looking to expand their investment knowledge or explore new opportunities, checking out the latest on investment platforms and tools can provide additional resources and insights.

Final Thoughts

Is news like Buffett’s financial strategy merely prudent management, or is it a clear signal for upcoming market turbulence? Investors would do well to keep these considerations in mind as they plan their financial strategies in the coming months.

Comments are closed.