$FXI $MCHI #ChinaEconomy #GlobalMarkets #InvestmentTrends #EconomicGrowth #TradeWars #MarketVolatility #FinancialAnalysis #EmergingMarkets #StockMarket #EconomicPolicy

Will China’s Latest Moves Reward Investors or Revive Old Concerns? Discover What’s at Stake in Our Latest Analysis!

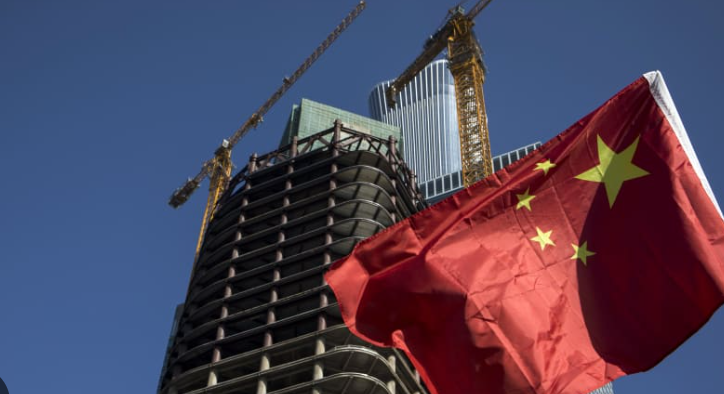

As indicators from varied data streams to social media buzz suggest, there is a growing apprehension surrounding China’s economic momentum. This sentiment affects not just local markets but also resonates globally, impacting investor strategies and market forecasts.

Understanding the Shift: A Dive into China’s Economic Dynamics

Recent reports highlight a discernible deceleration in China’s economic expansion, raising eyebrows among international investors and policy makers. This slowdown prompts a pertinent question: are we witnessing a temporary hiccup or a more profound economic shift? Analyzing the underlying factors reveals complexities in domestic policy adjustments and global trade tensions.

Market Reactions and Investor Sentiments: Reading Between the Lines

Market participants are keenly observing these developments, as the implications could be far-reaching. A slower growth rate in China, one of the global economic powerhouses, could signal reduced demand for commodities and lower import activity, affecting economies worldwide. This prospect has led to heightened volatility in both the stock markets and commodity prices.

Strategic Investment Opportunities Amidst Economic Slowdown

Despite these challenges, such economic climates often unveil unique investment opportunities. Savvy investors might find value in sectors that are poised to rebound or in assets that have been unduly penalized in the rush to react to news about the slowdown. Strategic positioning in these segments could potentially yield significant returns once the market corrects its initial reactions.

The Policy Perspective: What Measures Could China Take?

In response to the slowdown, Chinese authorities have a toolkit at their disposal that could be deployed to stabilize growth. Potential measures might include monetary policy easing, fiscal stimuli, or more targeted interventions in critical sectors. The effectiveness of these policies will be crucial in determining China’s ability to navigate through these turbulent waters.

Global Implications: The Ripple Effects of China’s Economic Health

The health of China’s economy doesn’t just affect local markets or industries; its impact is profoundly global. A sustained slowdown could dampen global economic prospects, particularly for countries and companies heavily reliant on Chinese demand. Conversely, a robust recovery strategy could reignite optimism across global markets, highlighting the interconnected nature of modern economies.

Looking Ahead: What Investors Should Watch

As this situation unfolds, investors should keep a close eye on China’s policy directions and any signals from cnbc’s news about further economic indicators. Monitoring these developments will be crucial in making informed decisions and adjusting investment strategies accordingly.

Final Thoughts: Balancing Caution with Opportunity

In conclusion, while the slowdown in China poses undeniable risks, it also opens up avenues for astute investors to capitalize on adjustments in market dynamics. Balancing caution with the pursuit of emerging opportunities will be key in navigating this complex economic landscape.

Comments are closed.