$SHEL $TTE $ORSTED

#Trump #Biden #WindEnergy #RenewableEnergy #StockMarket #OffshoreWind #EnergyPolicy #Infrastructure #Investing #ClimateChange #FederalRegulation #Business

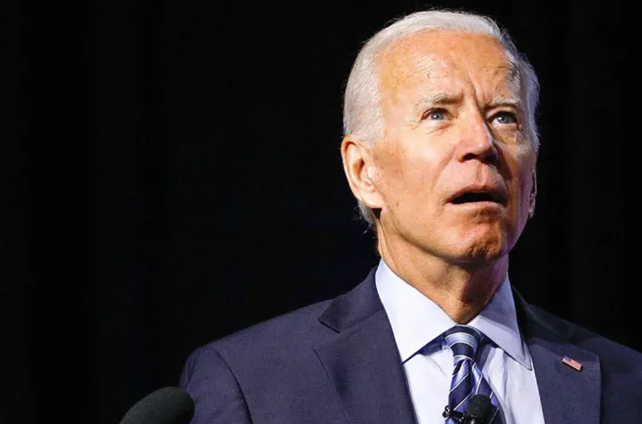

The Biden administration had ambitious plans to expand the wind energy sector, aiming to cover America’s skies with spinning turbines to boost renewable energy production. However, with Trump back in office, those aspirations have encountered a significant obstacle. On his very first day, Trump moved swiftly to suspend federal leasing and permitting for new wind energy projects, effectively halting the sector’s momentum. This abrupt policy shift has left major wind energy developers, including Shell ($SHEL), TotalEnergies ($TTE), and Orsted ($ORSTED), in a state of uncertainty, forcing them to reassess their long-term investment strategies. These companies had already invested billions into offshore and onshore projects, banking on continued federal support and incentives. Investors are now closely watching for potential financial write-downs, as companies face the risk of stranded assets and impaired balance sheets.

The impact on the financial markets could be significant. Shares of major wind energy players have already shown signs of volatility, with the broader renewable sector experiencing downward pressure. Orsted, one of the largest offshore wind developers, has previously suffered major financial setbacks due to rising costs and project cancellations. With the new administration’s hostility toward wind energy, the risk of further impairments could weigh on investor sentiment. Additionally, major oil and gas players like Shell and TotalEnergies, who had diversified into wind power to align with global net-zero goals, may need to reconsider their renewable energy strategies. A potential slowdown in wind development could shift capital back to traditional fossil fuel investments, which may see a surge in value amid renewed policy support for oil and gas projects.

Beyond corporate balance sheets, Trump’s policy shift has broader economic implications. The wind industry has been a significant source of job growth, particularly in coastal states that have invested heavily in offshore wind. Supply chain networks that support turbine manufacturing, transmission infrastructure, and workforce development may now face setbacks, creating uncertainty for thousands of workers. Financial institutions and public-private initiatives that had bet on wind expansion could also face financial strain, with lenders potentially reconsidering their exposure to wind projects. Meanwhile, states with aggressive clean energy targets may have to reconfigure their strategies, seeking alternative funding routes or legal challenges to keep projects afloat.

From a global perspective, Trump’s move could have ripple effects on the international renewable energy market. European and Asian energy giants that had expanded into the U.S. wind sector, expecting it to be a profitable growth area, may now shift investments elsewhere. Countries like China and Germany, which continue to push aggressive wind energy policies, could benefit from reduced U.S. competition. Additionally, this policy reversal signals broader uncertainty for investors regarding the long-term stability of U.S. energy regulations. Such unpredictability may deter foreign capital from entering the American renewable sector, potentially putting the U.S. at a competitive disadvantage in the global energy transition. Investors, policymakers, and industry leaders are now left contemplating whether this is a temporary setback or a fundamental shift in the country’s energy strategy.

Comments are closed.