#ChinaYuan #USDollar #InterestRateCuts #Exporters #ExchangeDifferentials #EconomicPolicy #CurrencyValues #FinancialMarkets

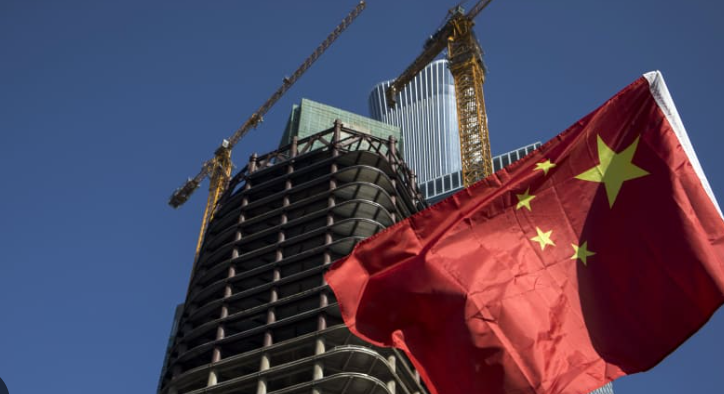

China’s financial landscape has been navigating turbulent waters as the yuan continues to weaken against the US dollar, a situation exacerbated by anticipated but unrealized interest rate cuts. This development has significant implications not just for the Chinese economy but for global financial markets at large. For years, China has been a dominant player in global trade, with its currency’s performance closely watched by investors and policymakers around the world. The yuan’s depreciation signals various underlying economic challenges and policy maneuvers that could have far-reaching effects.

The expectations for interest rate cuts in China were high, with many analysts predicting that the People’s Bank of China (PBOC) would take measures to stimulate the economy amidst slowing growth and ongoing geopolitical tensions. However, these anticipated cuts have yet to come to fruition, leaving the financial markets in a state of uncertainty. In response to this volatility, exporters in China, who are particularly sensitive to currency fluctuations, have been seeking alternative assets and strategies to mitigate their exposure to exchange rate differentials. This shift is indicative of a broader trend where market participants navigate through uncertainty by diversifying their asset holdings, a strategy that could influence global investment patterns.

The ongoing depreciation of the yuan against the US dollar is a complex phenomenon influenced by a myriad of factors, including trade balances, differential interest rates, and investor sentiment. When a country’s currency depreciates, its exports become cheaper and more competitive internationally, potentially boosting export volumes. However, this can also increase the cost of imports, contributing to inflationary pressures. Moreover, for a country like China, whose economy is significantly driven by exports, currency fluctuations can have a pronounced impact on trade dynamics. Exporters finding “whatever alternative assets they can” indicates a strategic pivot, underscoring the importance of financial resilience in times of currency volatility.

Looking ahead, the trajectory of China’s yuan and its monetary policy decisions will be critical in shaping not just its own economic recovery post-pandemic but also the stability and direction of global financial markets. The PBOC’s strategies in addressing these challenges will be closely scrutinized for indications of China’s economic policy direction and its implications for global trade and investment flows. The situation presents a nuanced picture of how central banks’ monetary policies, currency values, and the global trade environment are intricately linked, reflecting the complexities of managing an economy in the increasingly interconnected world of today. As exporters and investors navigate this uncertain terrain, the decisions made in the coming months could set the tone for economic dynamics in China and beyond for years to come.

Comments are closed.