#China #yuan #dollar #currency #economicnews #finance #globalmarkets #currencyexchange

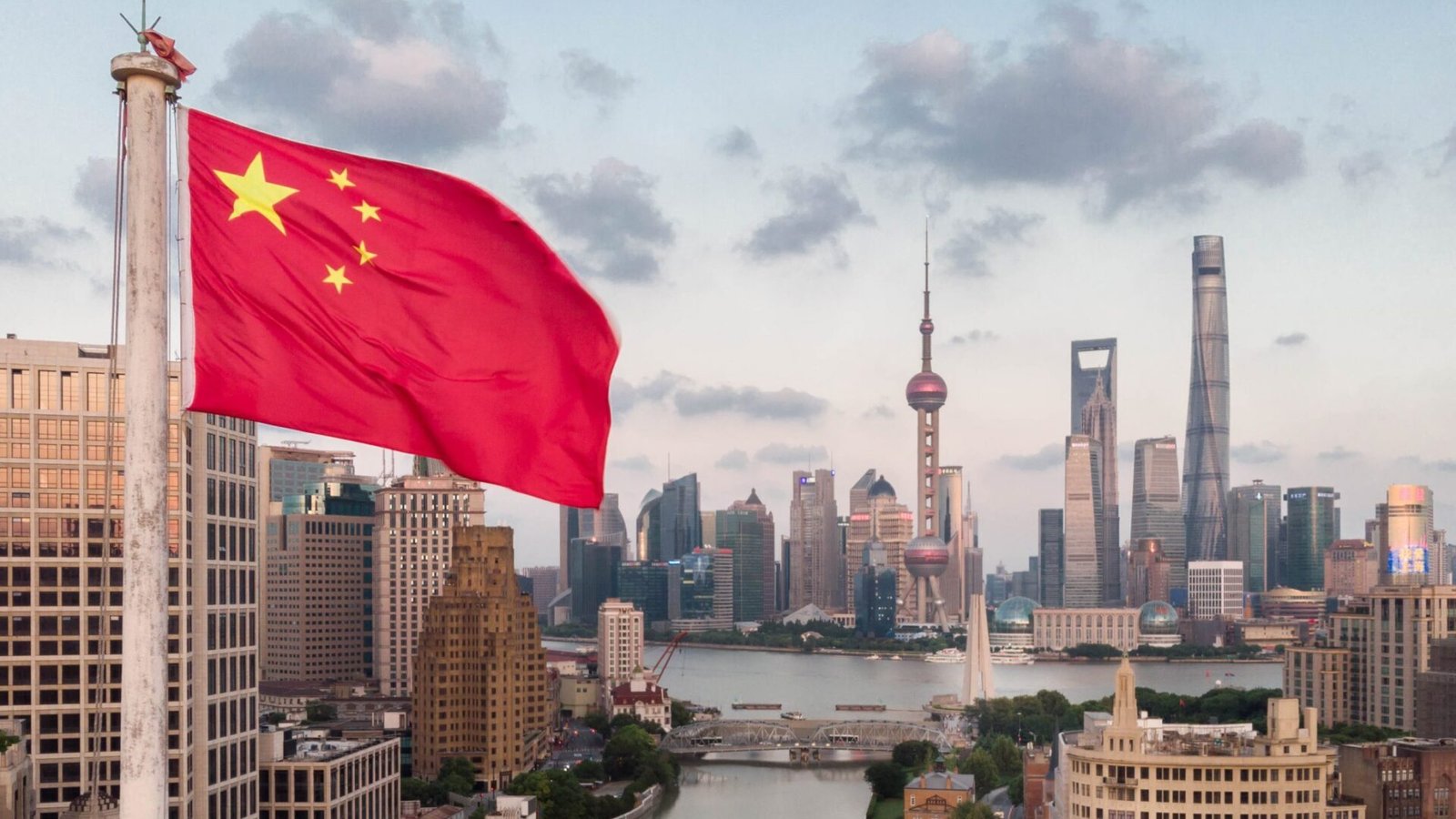

China’s financial landscape witnessed a significant shift as the yuan tumbled to its lowest level against the dollar in four months on a recent Friday, crossing a critical threshold that set alarm bells ringing across global currency markets. This depreciation in the yuan’s value instigated a swift response from state-owned banks in China, which intervened in an attempt to stabilize and defend the currency against further decline. This move underscores the delicate balance China seeks to maintain in its currency valuation, not just for domestic economic stability but also for its position in international trade and financial markets.

The breach of this key psychological level by the yuan against the dollar is emblematic of the larger tensions and dynamics at play within the global financial system. On one hand, a weaker yuan could potentially make Chinese exports more competitive on the global stage, providing a boost to the economy at a critical juncture. On the other hand, excessive devaluation poses risks of capital outflows, inflationary pressures, and might upset international trading partners. Consequently, the intervention by state-owned banks is not merely a defensive mechanism to support the yuan but also a strategic move to navigate these complex economic and geopolitical considerations. It reflects the Chinese government’s cautious approach towards ensuring economic stability and sustaining confidence among investors and international traders in its currency.

The incident is a stark reminder of the interconnectedness of global markets and the potential ripple effects that movements in key currencies can have worldwide. For investors, policymakers, and observers, it highlights the importance of tracking currency fluctuations and understanding the underlying factors driving such movements. China’s actions to support the yuan demonstrate the pragmatic steps nations may take to safeguard their economic interests. Looking ahead, the developments around the yuan will likely continue to be closely watched, as they hold significant implications for trade balances, monetary policy decisions, and the global economic outlook. The response to the yuan’s depreciation offers valuable insights into the intricacies of currency management in a globalized economy and the strategic considerations national authorities weigh in maintaining financial stability.

Comments are closed.