#WallStreet #S&P500 #TechStocks #BullMarket #Nvidia #AIChipmakers #EarningsReport #AIMarket

Wall Street recently witnessed yet another landmark achievement with the S&P 500 index brushing against the 5,000 point threshold, a first in its history. This surge to a fresh all-time high was significantly buoyed by the impressive performance of the market’s most significant technology stocks. The index’s journey upwards, marking over a 21% increase since its bottom in late October, highlights a robust bull market. Factors such as the conclusion of the Federal Reserve’s rate-hiking cycle, unexpectedly strong fourth-quarter earnings, and a surprisingly resilient domestic economy have contributed to this trend.

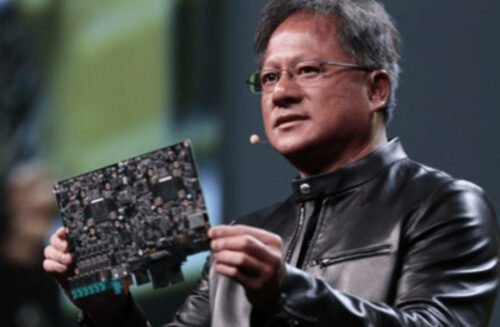

The spotlight, however, has been on the tech behemoths, often referred to as the “Magnificent 7,” which have significantly outperformed, delivering a substantial part of the S&P 500’s rally at the start of the year. Despite these gains, the tech-focused Nasdaq Composite remains slightly behind, yet to surpass its previous all-time high from November 2021. Among the standout performers within these tech giants, companies such as Amazon, Meta Platforms, Microsoft, and NVIDIA have been pivotal, contributing to nearly three-quarters of the S&P 500’s total returns this year. This performance underscores a substantial shift, marking a more pronounced influence of these top contributors compared to the previous year. The upcoming Nvidia earnings report is keenly anticipated as a potential catalyst that could propel the Nasdaq to join the S&P 500 and the Dow Jones in setting new records, further highlighting the impact of AI technology on the market’s current and future dynamics.

Image: https://weeklyfinancenews.online/wp-content/uploads/2023/09/nvda-e1692176333219.jpg

Comments are closed.