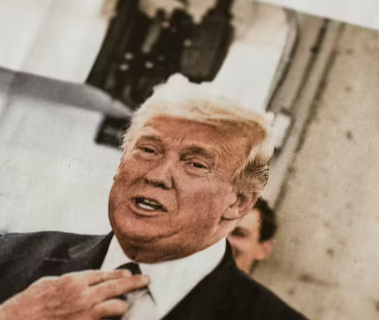

Why Did Trump Slap JPMorgan with a $5 Billion Lawsuit? Uncover the Billion-Dollar Battle Over Banking Rights

In a dramatic legal move, former President Donald Trump has filed a $5 billion lawsuit against JPMorgan. This lawsuit, central to current trump news, stems from the bank’s decision to sever financial ties with Trump in 2021. The case raises critical questions about the balance of power between financial institutions and their customers.

The Core of the Conflict: Trump’s Allegations Against JPMorgan

Trump alleges that JPMorgan’s decision to terminate his accounts was politically motivated and unjust. The lawsuit claims that the bank’s actions violated his rights as a customer and caused significant financial harm. Trump’s legal team argues that such debanking practices can set a dangerous precedent, potentially affecting individuals’ access to essential banking services.

Legal Implications and Broader Impact on the Banking Sector

The lawsuit could have far-reaching consequences for the banking industry. If Trump prevails, financial institutions might face increased scrutiny in their customer relationship management. This case could also influence regulatory approaches to ensure fair treatment of customers, regardless of political affiliations or public profiles.

JPMorgan’s Position: Navigating a Legal and Reputational Challenge

JPMorgan, meanwhile, contends that its decision was within its rights as a private entity. The bank emphasizes its commitment to maintaining ethical standards and ensuring compliance with internal policies. Navigating this legal battle will test JPMorgan’s reputation management strategies and its ability to uphold its standing in the financial community.

The Role of Politics in Financial Decision-Making

This lawsuit highlights the intersection of politics and finance, raising questions about the influence of political considerations on banking decisions. The case underscores the need for clear guidelines to prevent potential misuse of financial power for political ends.

Potential Ripple Effects on the Stock Market

Investors and analysts are closely watching the lawsuit’s developments, as a ruling in Trump’s favor might impact JPMorgan’s stock performance. The case could also influence investor perceptions of risk within the banking sector, prompting a reevaluation of investment strategies. For insights into market trends and stock performance, explore our stock market analysis.

Conclusion: Awaiting a Landmark Decision in Financial Law

The outcome of Trump’s lawsuit against JPMorgan will likely have significant implications for the banking industry and customer rights. As the case unfolds, it will serve as a crucial benchmark for evaluating the balance of power between financial institutions and their clients. Observers anticipate a decision that could redefine the boundaries of financial accountability and customer protection.

Understanding these dynamics requires vigilance, as the evolving landscape of financial law continues to shape the rights of individuals and the responsibilities of banking giants.

Comments are closed.