$SPY $QQQ #StockMarket #Investing #EconNews #WallStreet #MarketTrends #BankRecovery #USTrade #FinanceNews #MarketUpdate

Why Are Stocks Rebounding Amid Easing US-China Tensions and Bank Recoveries? Discover the Key Influences!

In today’s stocks news, the S&P 500 Index ($SPX) has shown a slight increase of +0.14%, reflecting a stable market sentiment. Meanwhile, the Dow Jones Industrials Index ($DOWI) has risen by +0.43%, and the Nasdaq 100 Index ($IUXX) has experienced a modest gain of +0.07%. These developments indicate a cautious optimism among investors as bank stocks recover and geopolitical tensions ease.

The December E-mini S&P futures (ESZ25) are currently up +0.10%, further contributing to a positive outlook. This stabilization comes at a critical time, as recent news suggests a thaw in US-China trade relations. Investors are closely watching how these factors will shape the market moving forward.

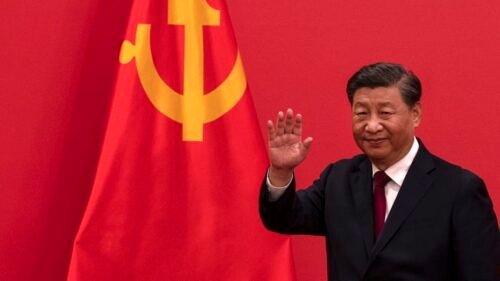

The Impact of US-China Relations on Market Sentiment

The easing of trade tensions between the US and China has played a pivotal role in boosting investor confidence. For months, uncertainty surrounding tariffs and trade policies has weighed heavily on the markets. However, recent discussions between the two nations indicate a willingness to cooperate, which bodes well for global economic stability.

This renewed dialogue could lead to increased trade flows and economic growth, benefiting numerous sectors, including technology and manufacturing. As a result, companies within the S&P 500 that rely heavily on international trade may see improved earnings projections, further driving stock prices upward.

Bank Stocks on the Rebound: A Sign of Stability

Another significant factor contributing to the current market rally is the recovery of bank stocks. Following a turbulent period characterized by fears of rising interest rates and potential defaults, banks are beginning to stabilize. This recovery is crucial, as the financial sector often serves as a bellwether for the overall economy.

As bank stocks regain their footing, investors are likely to feel more confident in the broader market. The resurgence of these stocks is not only a sign of improved financial health but also reflects a positive outlook on consumer spending and lending activity.

What Lies Ahead for Investors?

As we move forward, investors should remain vigilant. While the current market rebound is encouraging, it is essential to consider the potential risks associated with ongoing geopolitical developments and economic indicators. Analysts suggest that monitoring inflation rates and Federal Reserve policy will be critical in the coming months.

Additionally, fluctuations in the global economic landscape can have far-reaching effects. Investors may want to diversify their portfolios to mitigate risks while capitalizing on growth opportunities.

For those interested in exploring more about the stock market and gaining insights into various investment strategies, visit our stock section. This resource can provide valuable information to help navigate the current market climate.

In conclusion, the recent uptick in stock performance reflects a complex interplay of easing US-China tensions and the recovery of bank stocks. As we venture into this evolving economic environment, staying informed and adaptable will be key for investors aiming to capitalize on the opportunities that lie ahead.

Comments are closed.