Why Are $1B Fleeing Bitcoin and Ether ETFs As Crypto Slumps 6%?

In the latest wave of market volatility, investors are pulling out significant funds from Bitcoin and Ether ETFs, with outflows reaching nearly $1 billion in January alone. This abrupt shift in investor sentiment comes amid a broader market decline, where the crypto market has tumbled by 6%. The implications of these movements are profound, sparking concerns and discussions across financial markets. The intersection of bitcoin, news and ETF flows offers a lens into the intricate dynamics of the crypto economy.

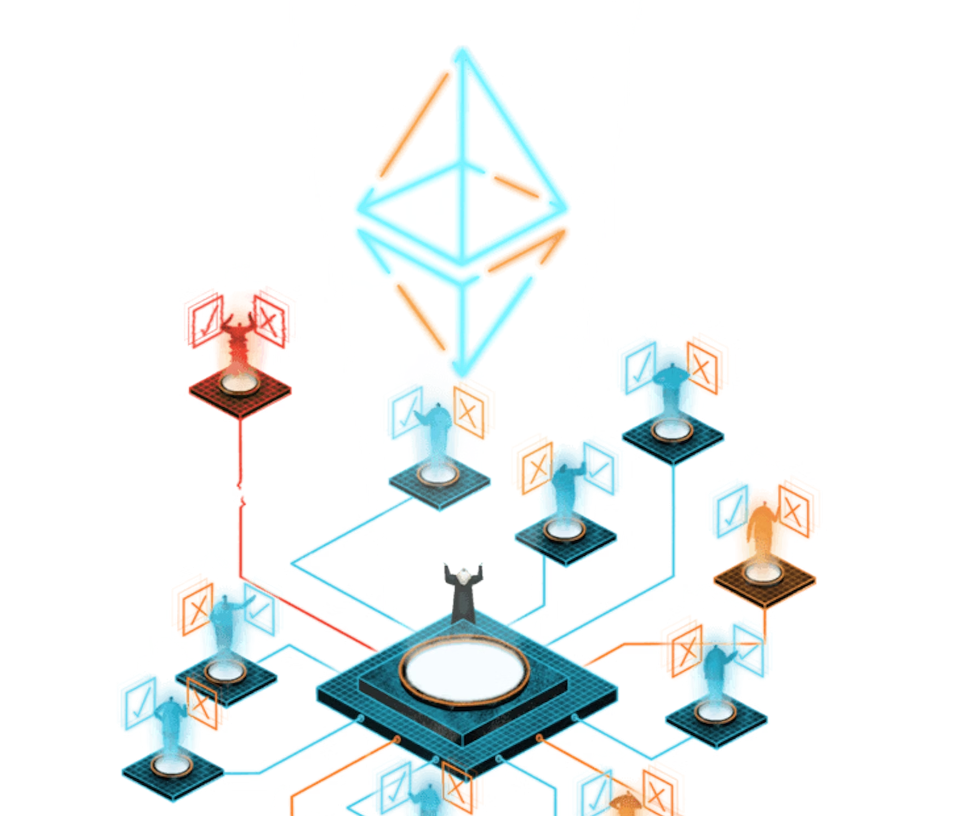

Understanding the Market Dynamics

The recent outflows from Bitcoin and Ether ETFs underscore a growing unease among investors. This unease is driven by several factors, including regulatory scrutiny, evolving macroeconomic conditions, and technical market indicators. As investors reassess their risk exposure, the exodus of capital from these digital assets highlights a shift in market sentiment. The ETF outflows also coincide with broader bearish trends in cryptocurrencies, with prices experiencing notable declines.

Regulation and Its Impact

A significant factor influencing these outflows is heightened regulatory scrutiny. Governments and financial regulators worldwide are increasingly focusing on the cryptocurrency sector. Concerns over money laundering, fraud, and investor protection are prompting new regulations. These regulatory measures create uncertainty, making some investors wary and prompting them to withdraw from crypto ETFs. This regulatory landscape is a key area to watch as policymakers balance innovation with oversight.

Macroeconomic Forces at Play

Global economic conditions also play a pivotal role in shaping investor behavior. Rising inflation, interest rate hikes, and geopolitical tensions contribute to market volatility. These factors impact risk appetite and asset allocation strategies, driving investors to reevaluate their portfolios. As macroeconomic conditions fluctuate, cryptocurrencies, often viewed as speculative assets, experience amplified volatility. Understanding these macro trends is crucial for investors seeking to navigate the challenging landscape of digital currencies.

Technical Factors and Market Sentiment

From a technical analysis perspective, recent price actions in Bitcoin and Ether suggest key support levels may be tested. The breach of these levels can trigger further selling pressure, exacerbating the current downturn. Market sentiment, often influenced by social media and news cycles, can amplify these technical signals. As prices fall, psychological factors such as fear and uncertainty can lead to more pronounced reactions among investors.

Future Outlook for Crypto ETFs

Despite the current challenges, the long-term outlook for crypto ETFs remains a subject of debate. Some analysts believe that market corrections are natural and provide opportunities for strategic entry points. Others caution against the inherent volatility and suggest that investors exercise caution. As the crypto market matures, understanding its nuances and staying informed through relevant text is essential for making informed decisions.

In conclusion, the $1 billion outflow from Bitcoin and Ether ETFs reflects a complex interplay of regulatory, macroeconomic, and technical factors. Investors must navigate this evolving landscape with a keen understanding of market dynamics and an eye on future developments. As the crypto sector continues to grow, staying informed and adapting to change will be key to capitalizing on opportunities while managing risks.

Comments are closed.