# $ETH #Ethereum #CryptoMarket #Stablecoins #Blockchain #DeFi #Web3 #CryptoNews #DigitalAssets #Finance #Investing #CryptoTrends

How Did Ethereum Achieve a Record $8T in Stablecoin Transfers This Quarter? Uncover the Impact!

In a landmark achievement for the blockchain ecosystem, stablecoin transfer volume on the Ethereum network surged to an unprecedented $8 trillion in the fourth quarter of 2025. This significant milestone highlights the growing reliance on stablecoins within the cryptocurrency landscape, underscoring Ethereum’s pivotal role in shaping the future of digital finance. This article delves into the factors driving this record-high transfer volume and its implications for the broader market, making it a vital piece of ethereum news for investors and enthusiasts alike.

The Rise of Stablecoins on Ethereum

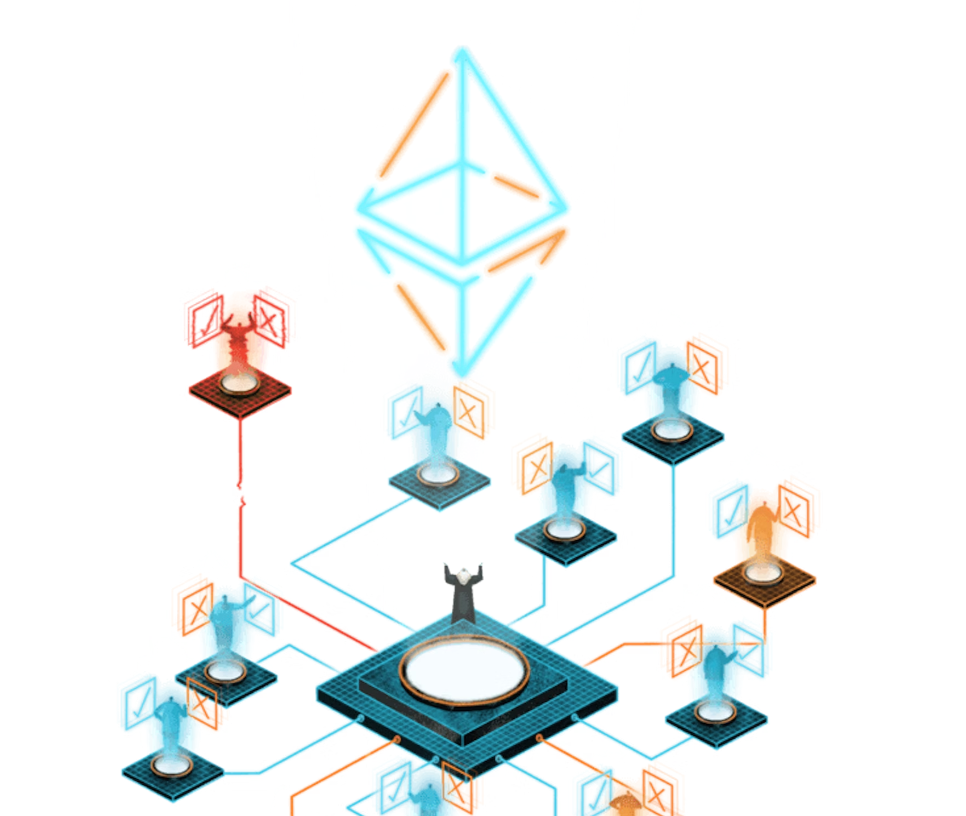

Stablecoins, designed to maintain a stable value by pegging to traditional assets like the U.S. dollar, have gained traction due to their utility in various decentralized finance (DeFi) applications. As Ethereum continues to dominate the DeFi sector, the network has become a preferred choice for stablecoin transactions. The combination of Ethereum’s smart contract capabilities and its vibrant ecosystem has made it an attractive platform for users seeking to execute transactions quickly and securely.

Several factors contributed to this surge in stablecoin transfers. First, the increasing volume of decentralized exchanges (DEXs) facilitated higher trading activity, allowing users to easily swap stablecoins without relying on traditional banking systems. Additionally, the expansion of lending and borrowing protocols within the DeFi space encouraged users to leverage stablecoins for yield farming and liquidity provision.

Market Dynamics and User Adoption

The impressive $8 trillion figure not only reflects a growing trend in stablecoin usage but also indicates a shift in how investors perceive digital assets. As more individuals and institutions adopt cryptocurrencies, the demand for stablecoins continues to rise. This shift is partly driven by the need for a stable means of transferring value amidst market volatility.

Furthermore, regulatory developments are shaping the stablecoin landscape. As governments worldwide seek to establish frameworks for digital assets, the legitimacy of stablecoins is increasing. This regulatory clarity may further boost user adoption, leading to more transactions on networks like Ethereum.

Implications for the Broader Crypto Ecosystem

The record transfer volume of stablecoins on Ethereum signals a transformative moment for the crypto market. Increased stablecoin activity can lead to greater liquidity across various decentralized platforms. This, in turn, can attract more users to the ecosystem, fostering further innovation and investment.

Moreover, the rise of stablecoins could pave the way for enhanced interoperability between different blockchain networks. As users seek seamless experiences, the integration of stablecoins across platforms may become a priority, fostering collaboration and competition among blockchain projects.

Looking Ahead: What’s Next for Ethereum and Stablecoins?

As we move forward, the focus on stablecoins is likely to intensify. Investors should keep a close watch on developments within the Ethereum network and its competitors. The continuous evolution of DeFi protocols, coupled with advancements in technology, will undoubtedly shape the future of stablecoin transfers.

For those interested in exploring the world of cryptocurrencies further, consider visiting our crypto news section for the latest updates and insights. Additionally, for a secure trading experience, check out Binance, a leading platform for trading digital assets.

In conclusion, the remarkable growth of stablecoin transfers on Ethereum underscores the network’s resilience and adaptability. As the cryptocurrency landscape evolves, staying informed about these trends will be crucial for investors and enthusiasts alike.

Comments are closed.