# $HSBC $BABA #AsiaPacific #MarketTrends #Investors #China #EconomicOutlook #LendingRates #StockMarket #InvestmentStrategies #FinancialNews

Will Asia-Pacific Markets Keep Climbing? Key Decision Ahead in China’s Lending Rates Awaits.

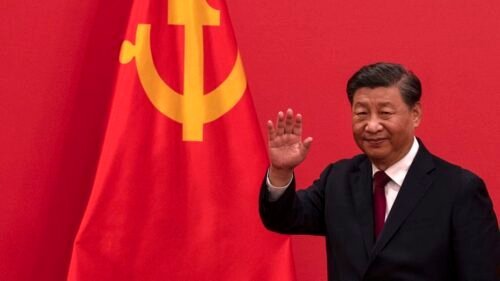

Asia-Pacific markets showed an upward trend on Monday, driven by investor optimism as they anticipate significant announcements regarding benchmark lending rates from China. This development is crucial for market participants, particularly in the context of rising economic uncertainties and shifting monetary policies. As investors digest this asia-pacific news, the spotlight remains on how China’s decisions will influence both regional and global economic landscapes.

The anticipation centers around the People’s Bank of China (PBOC) and its forthcoming adjustments to the lending rate. A change in this benchmark can alter the borrowing costs for businesses and consumers, which ultimately impacts economic growth. Analysts predict that a rate cut could stimulate spending and investment, supporting the economy amid ongoing challenges such as supply chain disruptions and slowing growth rates. Investors are closely monitoring these developments, as they could signal broader trends in monetary policy across the region.

Economic Impact of China’s Lending Rate Decision

As the world’s second-largest economy, China plays a pivotal role in the Asia-Pacific region. Its monetary decisions have far-reaching implications. A reduction in the lending rate could lead to increased liquidity in the markets, potentially boosting stock prices across various sectors. Investors are keenly aware that lower borrowing costs can lead to higher consumer confidence and increased spending, which are essential for economic recovery.

Furthermore, China’s lending rate decision will likely influence currencies and commodities. A shift towards lower rates may weaken the yuan, impacting trade relationships and foreign investments. Conversely, stability in the lending rates could bolster confidence among investors, promoting a positive sentiment in the markets.

Market Reactions and Sector Performance

Leading financial institutions such as HSBC and Alibaba are pivotal players in this landscape. Their stock performance often reflects broader market trends and investor sentiment. As the lending rate decision approaches, investors in these stocks may experience heightened volatility. It is essential to analyze the sectors most sensitive to changes in lending rates, such as real estate and consumer discretionary.

Furthermore, the technology sector, which includes major players like Alibaba, may see increased activity as lower borrowing costs facilitate innovation and expansion. As we assess market trends, it is crucial to remain vigilant about how these sectors react in anticipation of the PBOC’s decision.

Conclusion: Navigating Uncertain Waters

In conclusion, the Asia-Pacific markets are on an upward trajectory as they await critical updates on China’s lending rates. Investors must stay informed and agile, ready to adjust their strategies based on potential outcomes. As the financial landscape evolves, it is vital to consider both immediate market reactions and long-term implications of these decisions.

For more insights on stock market trends and investment opportunities, visit our stock section. Additionally, engage with the latest financial news to navigate these uncertain waters effectively. As the situation develops, staying informed will empower investors to make data-driven decisions in a rapidly changing economic environment.

Comments are closed.