# $AMZN $GOOGL #WarrenBuffett #QuantumComputing #BerkshireHathaway #Investing #StockMarket #FinancialNews #TechInvestments #MarketTrends #BuffettWisdom

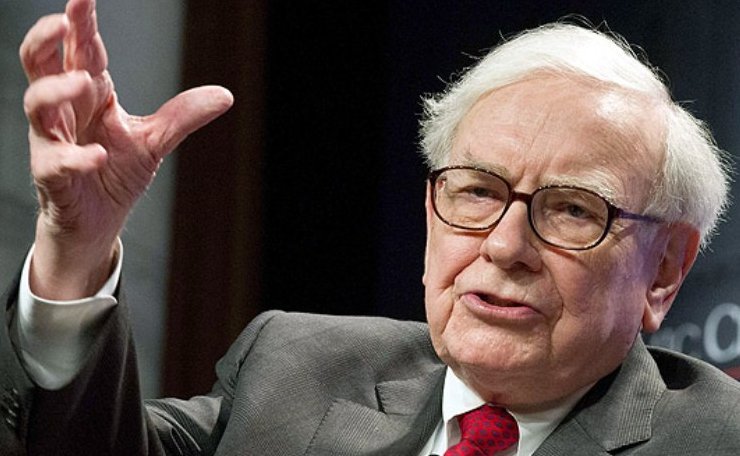

How Did Warren Buffett Invest $7.7 Billion in Quantum Computing for Massive Returns?

Recent news highlights Warren Buffett’s bold investment strategy, revealing that $7.7 billion of Berkshire Hathaway’s portfolio is tied up in two quantum computing stocks: Alphabet and Amazon. This substantial stake reflects Buffett’s confidence in the transformative potential of quantum technology. As the landscape of technology investment evolves, understanding Buffett’s choices offers valuable insights into the future of market trends and innovation.

Buffett, renowned for his investment acumen, often focuses on companies with strong fundamentals and growth potential. His investments in Alphabet (Google’s parent company) and Amazon position Berkshire Hathaway strategically within the burgeoning quantum computing sector. Both firms are at the forefront of technological advancements, including artificial intelligence and machine learning, which are expected to drive the next wave of economic growth.

Quantum computing promises to revolutionize industries by solving complex problems at unprecedented speeds. For instance, Google’s quantum computer has already achieved significant milestones, such as demonstrating quantum supremacy. Similarly, Amazon’s investments in quantum technologies through AWS Quantum Solutions are paving the way for businesses to harness this cutting-edge capability. Hence, Buffett’s $7.7 billion investment signifies a long-term vision, as he anticipates these companies will dominate the tech landscape.

Investors should closely monitor how quantum computing evolves, as it could redefine sectors such as finance, logistics, and pharmaceuticals. The implications of this technology extend beyond mere investment returns; they may also reshape global trade dynamics and economic policies. As quantum computing matures, it will likely influence how companies approach data security and computational efficiency, making it a game-changer for various industries.

Buffett’s strategy also aligns with a broader trend in the investment community where tech giants are increasingly diversifying their portfolios. By investing in quantum computing, Buffett is not only positioning Berkshire Hathaway for potential financial gains but also embracing a future where technology plays a central role in economic development.

Investors looking to replicate Buffett’s approach should consider the fundamentals of companies within the quantum space. Key indicators, such as market capitalizations, earnings potential, and sector trends, are essential for making informed investment decisions. Additionally, keeping an eye on regulatory developments and technological improvements will provide a clearer picture of the market’s trajectory.

In summary, Warren Buffett’s substantial investment in quantum computing through Alphabet and Amazon underscores his belief in the technology’s potential to revolutionize industries. The $7.7 billion investment reflects a calculated risk, offering insights into his long-term vision for economic growth and innovation. As quantum computing continues to advance, investors should remain vigilant and adaptable, ready to seize opportunities in this rapidly evolving landscape.

For more insights on stock market trends and investment strategies, explore our stock section. Stay informed as we continue to cover the financial landscape and the impacts of emerging technologies on investment strategies.

Comments are closed.