$JUP $CRO #CryptoNews #Bitcoin #Altcoins #Investing #MarketTrends #CryptoTrading #CROLift #Cryptocurrency #InvestmentStrategy #FinancialNews #WeekendWatch

Why Did CRO Surge 5% in a Day and What Does BTC’s Stability Post-CPI Mean for Your Wallet?

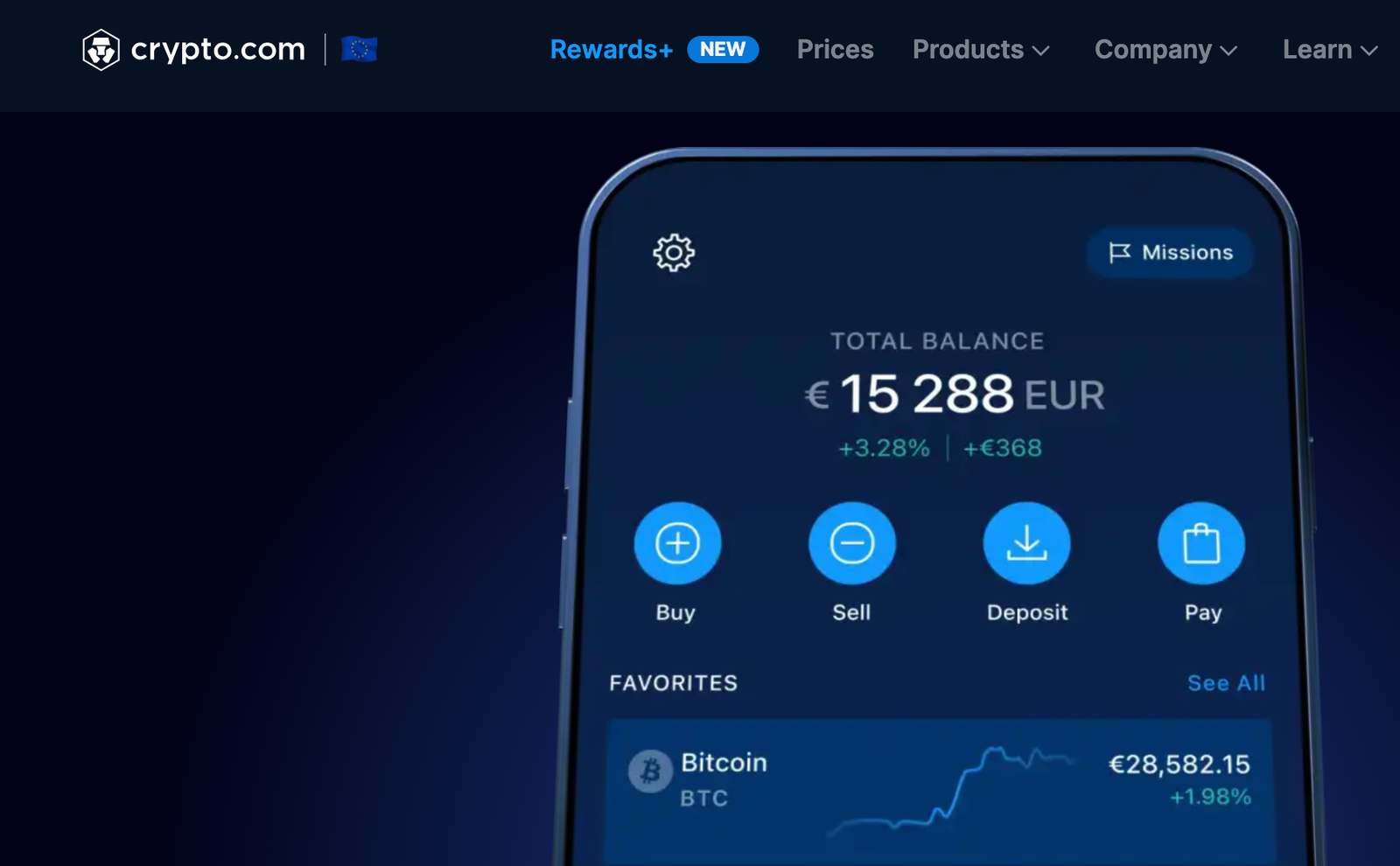

In today’s market overview, the latest cro news highlights that $JUP has emerged as the top gainer among the largest 100 altcoins. This remarkable performance indicates a growing interest in altcoins, particularly as the market reacts to recent economic data. Investors are keenly observing the overall landscape, especially after the recent Consumer Price Index (CPI) report that has affected both cryptocurrencies and traditional markets.

The surge in CRO, which rose by 5% in a single day, can largely be attributed to a combination of factors. First, the positive sentiment surrounding the cryptocurrency market, fueled by increased trading volumes and institutional interest, has played a crucial role. As more investors look to diversify their portfolios, altcoins like CRO are becoming increasingly appealing due to their potential for significant gains.

Moreover, the stability of Bitcoin ($BTC) following the CPI report indicates a consolidation phase, which often precedes further upward movement. When Bitcoin stabilizes, it tends to provide a favorable environment for altcoins to flourish. Traders view this stability as a sign that market participants are regaining confidence, which often leads to increased buying activity in altcoins like CRO.

Understanding the Broader Implications of CRO’s Performance

To fully grasp the implications of CRO’s recent surge, it’s essential to analyze the broader economic context. As inflation concerns continue to loom, the CPI report has underscored the importance of monitoring economic indicators. The cryptocurrency market often reacts sensitively to such reports, and CRO’s rise suggests that investors are seeking alternative assets as potential hedges against inflation.

Furthermore, the correlation between Bitcoin’s price movements and altcoin performance is a critical consideration. Historically, when Bitcoin stabilizes or climbs, altcoins tend to follow suit. The recent data indicates that while Bitcoin remains relatively stable, altcoins are capturing the attention of traders eager for volatility and potential gains. As such, CRO’s rise can be viewed within this larger framework of market dynamics.

What’s Next for Investors?

For those invested in cryptocurrencies, the current market conditions present both opportunities and risks. Investors should consider their risk tolerance and investment strategies carefully. A prudent approach involves not only keeping an eye on Bitcoin’s performance but also monitoring the altcoin market, where opportunities like CRO are emerging.

As you explore your investment options, it may be beneficial to broaden your knowledge of the altcoin landscape. For more insights on cryptocurrencies, you can visit our crypto section for in-depth analysis and updates.

Additionally, if you’re considering trading or investing in cryptocurrencies, platforms like Binance offer valuable resources. You can explore their offerings through this link to find out more about their services.

In conclusion, while CRO’s 5% rise signals a positive shift in the altcoin market, the stability of Bitcoin post-CPI suggests a cautious optimism moving forward. Investors should stay vigilant and informed, as the interplay between Bitcoin and altcoins will continue to shape the market landscape in the weeks to come.

Comments are closed.