$SPX $DIA #StockMarket #Investing #Chipmakers #ChinaTensions #MarketTrends #EconomicOutlook #Finance #InvestSmart #Trading #WallStreet #MarketNews

Why Are Stocks Falling Amid Chipmaker Struggles and China Tensions? Discover the Impact on Your Portfolio!

In today’s stocks news, investors faced a disappointing day in the markets as major indices experienced significant declines. The S&P 500 Index ($SPX) closed down 0.53%, while the Dow Jones Industrials Index ($DOWI) dipped by 0.71%. Furthermore, the Nasdaq 100 Index ($IUXX) suffered the largest loss, retreating by 0.99%. This downward trend can be attributed to renewed tensions with China and ongoing struggles within the semiconductor sector, raising concerns among investors.

Understanding the Chipmaker Weakness

The semiconductor industry is currently grappling with multiple challenges, including supply chain disruptions and heightened geopolitical tensions. Companies in this sector, which are vital for the production of various technologies, have been under pressure due to reduced demand forecasts. As major chipmakers report weaker earnings, it further exacerbates fears of an economic slowdown. This sector’s volatility has a ripple effect, influencing investor sentiment across broader markets.

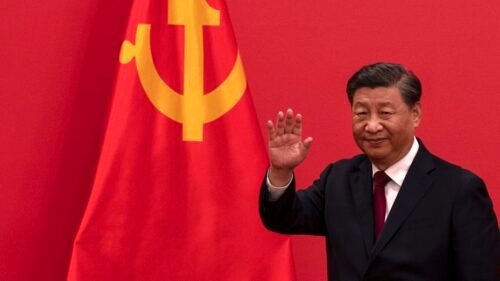

China’s Role in the Market Dynamics

Simultaneously, renewed tensions between the United States and China have added fuel to the fire. Trade disputes and regulatory uncertainties create an unpredictable environment for investors. As the world’s two largest economies continue to navigate their complex relationship, market participants are increasingly wary of how these tensions will affect global supply chains and trade dynamics. The fear of potential retaliatory measures from either side only heightens the atmosphere of uncertainty, contributing to the sell-off in the stock markets.

What This Means for Your Portfolio

Given these developments, investors must take a closer look at their portfolios. The declines observed in key indices suggest that diversification remains crucial. Investors should consider balancing their holdings with sectors that demonstrate resilience, such as renewable energy or biotechnology, thus mitigating risks associated with tech-heavy indices.

Moreover, it’s essential to stay informed about macroeconomic indicators and geopolitical events that could influence market conditions. Engaging in regular portfolio reviews, along with strategic adjustments, can help investors navigate these turbulent waters.

Future Outlook: What Lies Ahead?

Looking forward, market analysts suggest that until there is clarity regarding the semiconductor sector’s recovery and U.S.-China relations stabilize, volatility may persist. Therefore, investors should remain cautious and prepared for potential market fluctuations.

To keep up with the evolving landscape of stock markets, consider exploring more insights and analyses that can help inform your investment strategies.

In conclusion, the current downturn in stocks reflects broader economic concerns tied to both chipmaker struggles and geopolitical tensions. For investors, understanding these dynamics is essential for making informed decisions and protecting their financial interests amid uncertainty.

Comments are closed.