$SPY $QQQ #StocksNews #MarketUpdate #Investing #Finance #Chipmakers #ChinaTensions #EconomicOutlook #WallStreet #DowJones

Why Are Stocks Falling? Chip Weakness and China Tensions to Blame!

In today’s stocks news, major indices faced a setback as investor sentiment wavered amidst growing concerns over chipmaker performance and escalating tensions with China. The S&P 500 Index ($SPX) closed down by 0.53%, reflecting a broader market retreat. Similarly, the Dow Jones Industrials Index ($DOWI) fell by 0.71%, while the tech-heavy Nasdaq 100 Index ($IUXX) experienced a decline of 0.99%. This downward trend in the market signals a cautious outlook, driven by specific vulnerabilities in the semiconductor industry and geopolitical uncertainties.

The Impact of Chipmaker Weakness

Chipmakers have been integral to the technology sector’s growth, and their recent struggles have raised red flags for investors. Companies within this industry are grappling with supply chain disruptions and reduced demand, which have put pressure on stock prices. As a result, investors are reevaluating their positions, leading to a sell-off in tech stocks. This trend was evident in the performance of major tech firms, which heavily influence indices like the Nasdaq.

Moreover, expectations for future earnings reports are dampened. Analysts are lowering their forecasts, anticipating that the semiconductor sector will continue to face headwinds in the near term. Consequently, this has led to a ripple effect across the broader market, as uncertainty breeds caution among investors.

Geopolitical Concerns: Renewed Tensions with China

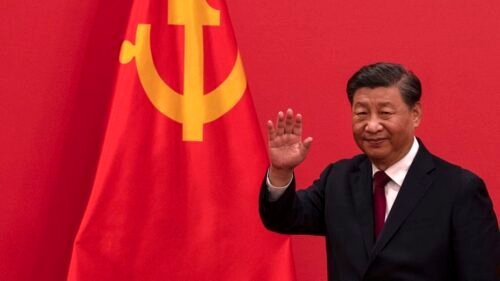

In addition to chipmaker challenges, renewed tensions between the United States and China have contributed to market volatility. Ongoing disputes over trade policies, technology exports, and military presence in the Asia-Pacific region create an environment of uncertainty. Investors are wary of these geopolitical risks, which could have far-reaching implications for global supply chains and economic stability.

As both nations navigate their complex relationship, the potential for further escalations adds a layer of unpredictability to the financial markets. This uncertainty has caused many investors to adopt a more defensive posture, leading to the observed declines in major indices.

Futures Market Reaction

The futures market also reflected this bearish sentiment. December E-mini S&P futures (ESZ25) fell by 0.52%, while December E-mini Nasdaq futures experienced similar declines. These movements indicate that traders are bracing for continued volatility and may be anticipating further adjustments in the coming days.

Looking Ahead: A Cautious Approach

As we move forward, investors should remain vigilant and monitor developments in both the semiconductor industry and geopolitical relations, especially with China. The combination of these factors could shape market sentiment for the foreseeable future. It is crucial for investors to stay informed and consider diversifying their portfolios to mitigate risks associated with these uncertainties.

For more insights and updates on stock market trends, feel free to explore our stock news section. Engaged investors should keep an eye on how these evolving situations will impact their strategies in the short and long term.

Comments are closed.