$SPY $DIA #Inflation #Economy #JoblessClaims #ConsumerPrices #FinancialNews #StockMarket #Investing #EconomicIndicators #MarketTrends

How Does a 2.9% Rise in Consumer Prices Impact Your Wallet as Jobless Claims Surge?

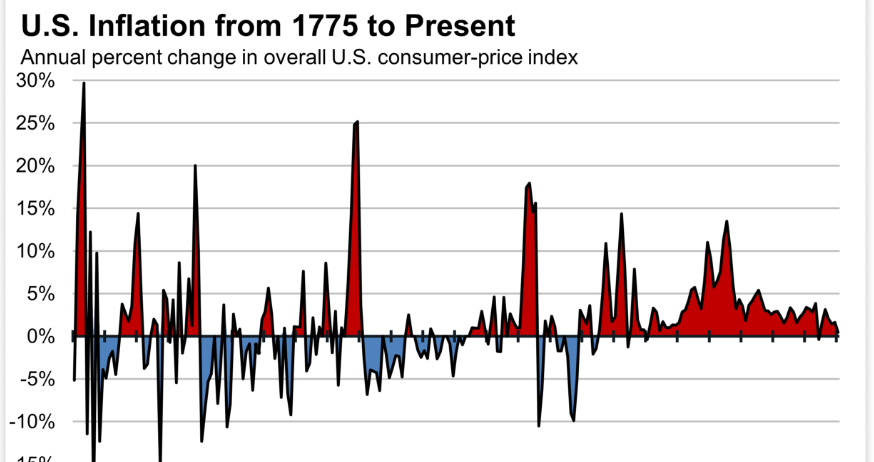

In the latest update on consumer news, the consumer price index (CPI) was projected to climb by 0.3% in August, aligning with the Dow Jones consensus estimate. This uptick is part of a broader trend that saw consumer prices ascend at an annual rate of 2.9% during the same month. Simultaneously, an unexpected rise in weekly jobless claims has been reported, complicating the economic landscape for consumers and investors alike.

Understanding the CPI Increase

The CPI measures what consumers pay for goods and services, and its increase is a clear indicator of rising inflation. This inflation affects every dollar you earn, spend, and save. For households, this means that the buying power of your income diminishes as prices for everyday items, from groceries to gasoline, increase.

The Ripple Effect of Inflation on Investments

For investors, particularly those involved in the stock market, inflation can be a double-edged sword. On one hand, it can erode the value of money and reduce the real returns on investments. On the other hand, certain assets, like real estate or commodities, may benefit from inflationary pressures as they tend to rise in value when prices increase.

Jobless Claims and Economic Uncertainty

An increase in jobless claims indicates more people are losing their jobs, which can further strain economic growth. This rise is particularly concerning because it suggests that businesses are facing pressures that could lead to layoffs, reducing consumer spending power and potentially leading to a slower economic recovery.

Strategic Moves for Personal Finance

During times of rising consumer prices and jobless claims, it’s crucial to reassess your financial strategies. This might mean tightening your budget, focusing on saving, or investing in assets that are less sensitive to inflation. Additionally, considering secure employment opportunities becomes even more essential.

Implications for Future Economic Policies

This economic scenario will likely influence future policies as governments and central banks try to manage inflation without stifling growth. Measures could include adjusting interest rates, which directly affects inflation and economic expansion.

Conclusion: Navigating Through Economic Shifts

As consumer prices continue to rise and jobless claims surge, understanding the broader economic context is crucial. Staying informed about these trends will help you make more educated decisions about your finances and investments. For more insights into how these economic indicators affect the stock market, visit our stock market analysis.

This scenario underscores the importance of vigilance and adaptability in personal and investment financial strategies. As the economy navigates through these turbulent waters, staying informed and agile will be key to maintaining financial health and capitalizing on emerging opportunities.

Comments are closed.