$MSTR $SPY #StockMarket #Investing #Finance #Crypto #Bitcoin #S&P500 #MSTRNews #Robinhood #MarketTrends #EconomicInsight

Why Did MSTR Stock Drop 2.9% After Being Overlooked for the S&P 500 While Robinhood Made the Cut? Discover What This Means for Investors.

In recent market developments, MicroStrategy’s stock (MSTR) experienced a notable decline of 2.9% following news that it was not included in the S&P 500 index. This event coincided with the inclusion of Robinhood, a decision that sparked considerable discussion among investors. Here’s an in-depth analysis to understand the dynamics behind MSTR’s recent market performance and what it signals for future investments.

The Significance of S&P 500 Inclusion

Being listed on the S&P 500 is not just a badge of honor; it’s a catalyst for increased demand for a company’s stock. Index funds and a variety of portfolios that track the S&P 500 automatically adjust their holdings to include a new entrant, which usually results in a surge of stock purchases. Conversely, companies not making the cut, like MicroStrategy in this instance, may see diminished investor interest and a consequential drop in stock price.

MicroStrategy’s Strategic Decisions and Market Response

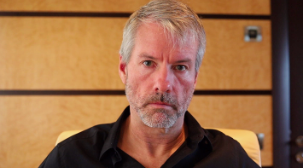

MicroStrategy has been highly publicized for its aggressive acquisition of Bitcoin, a strategy spearheaded by CEO Michael Saylor. Initially, this led to heightened investor interest as the price of Bitcoin soared. However, as the pace of these acquisitions slowed in Q3, combined with the company’s omission from the S&P 500, investor sentiment cooled, reflecting in the stock’s price dip.

For more insights into stock trends, visit our dedicated section on stock market analysis.

Understanding the Market’s Mixed Signals

The market’s response to MSTR’s strategy and its exclusion from the S&P 500 underscores a complex interplay of investor psychology, corporate strategy, and macroeconomic factors. While MicroStrategy’s Bitcoin acquisition strategy positions it uniquely in the tech and financial sectors, its benefits and risks are perceived differently by various investor segments. Moreover, the broader economic context, including inflation concerns and interest rate hikes, plays a crucial role in shaping these perceptions.

What Investors Should Watch Moving Forward

Moving forward, MSTR investors should keep a keen eye on several factors. The company’s future Bitcoin purchasing strategies, the overall health of the cryptocurrency market, and further developments in tech sector regulations will be pivotal. Additionally, monitoring shifts in investor sentiment following market reactions to similar S&P 500 snubs or inclusions will provide valuable strategic insights.

Conclusion: Navigating a Shifting Landscape

The recent decline in MSTR’s stock price following its S&P 500 exclusion presents a nuanced picture of the current financial landscape. For savvy investors, this underscores the importance of staying informed about corporate strategies and market movements. As the market continues to evolve, aligning investment strategies with these changes will be key to capitalizing on emerging opportunities.

In the rapidly changing world of finance, keeping up with the latest trends and shifts is essential. For those looking to deepen their understanding of the market dynamics, consider exploring more about strategic investment decisions on platforms like Binance, which offers a range of resources for both novice and experienced investors.

By maintaining a vigilant and informed approach, investors can navigate through uncertainties and position themselves advantageously in a competitive market environment.

Comments are closed.