$AI $AAPL #ElonMusk #Apple #OpenAI #AITokens #CryptoMarket #Antitrust #Investing #FinancialNews #TechNews #Regulation

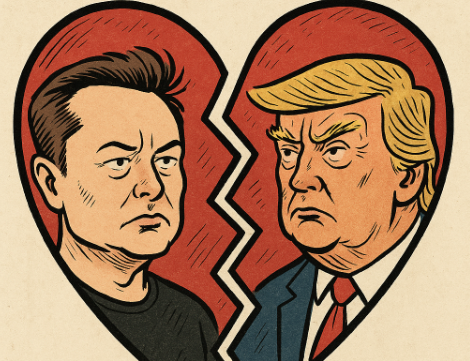

Will Elon Musk’s Lawsuit Against Apple and OpenAI Crash AI Token Values? Discover the Financial Impact!

In the latest turn of events shaking the foundations of the tech and financial sectors, Elon Musk has filed a groundbreaking antitrust lawsuit against tech giant Apple and AI frontrunner OpenAI. This legal challenge is not just a high-stakes battle among Silicon Valley titans; it’s also sending shockwaves through the cryptocurrency markets, particularly affecting AI-focused tokens.

The Catalyst of the Crypto Chaos

As news of the lawsuit hit the media, it created an immediate impact on the AI crypto sector. Investors, already navigating a maze of regulatory uncertainties, found themselves in a panic, leading to a notable slump in AI token values. The volatility reflects deep-seated fears about potential regulatory repercussions that could reshape the landscape of AI development and deployment.

Exploring the Depth of Market Reactions

The reaction in the markets was swift and severe. AI tokens, which had been enjoying a relatively stable position, tumbled as investors scrambled to assess the implications of Musk’s legal move. This lawsuit introduces a layer of unpredictability that could deter investment into AI technologies, at least in the short term, as stakeholders weigh the risks of further regulatory scrutiny.

Financial and Technological Implications

This legal confrontation raises numerous questions about the future of AI development and the balance of power in tech industries. Elon Musk’s decision to take on Apple and OpenAI could set precedents for how competitive practices are managed in tech, potentially leading to more stringent regulations that could stifle innovation or alternatively, open up the market to new players.

Explore more about the cryptocurrency implications of current events.

Potential Outcomes and Investor Strategies

Investors and market analysts are closely monitoring the situation, trying to predict the legal outcome and its eventual impact on the markets. A prolonged legal battle could lead to significant fluctuations in AI token prices, affecting not just individual investors but also the companies relying on these technologies for their products and services.

Invest in cryptocurrency safely with Binance.

Looking Ahead: Navigating Through Uncertainty

As the situation unfolds, it will be crucial for investors and companies to stay informed and agile, ready to adapt to any changes that might come from this legal challenge. The outcome could have far-reaching effects on investment trends, regulatory frameworks, and the development trajectory of AI technologies.

Conclusion: A Watershed Moment in Tech and Finance

Elon Musk’s lawsuit against Apple and OpenAI is more than just a legal battle; it’s a pivotal moment that could redefine the interplay between technology, finance, and regulation. As the case progresses, the financial world remains on edge, watching closely as this drama unfolds, potentially reshaping the future of AI investments and the broader tech landscape.

Comments are closed.