$ETH #Ethereum #CryptoMarket #LeverageRisk #CryptoTrading #Blockchain #DigitalAssets #Investing #Finance #MarketVolatility #CryptoAnalysis

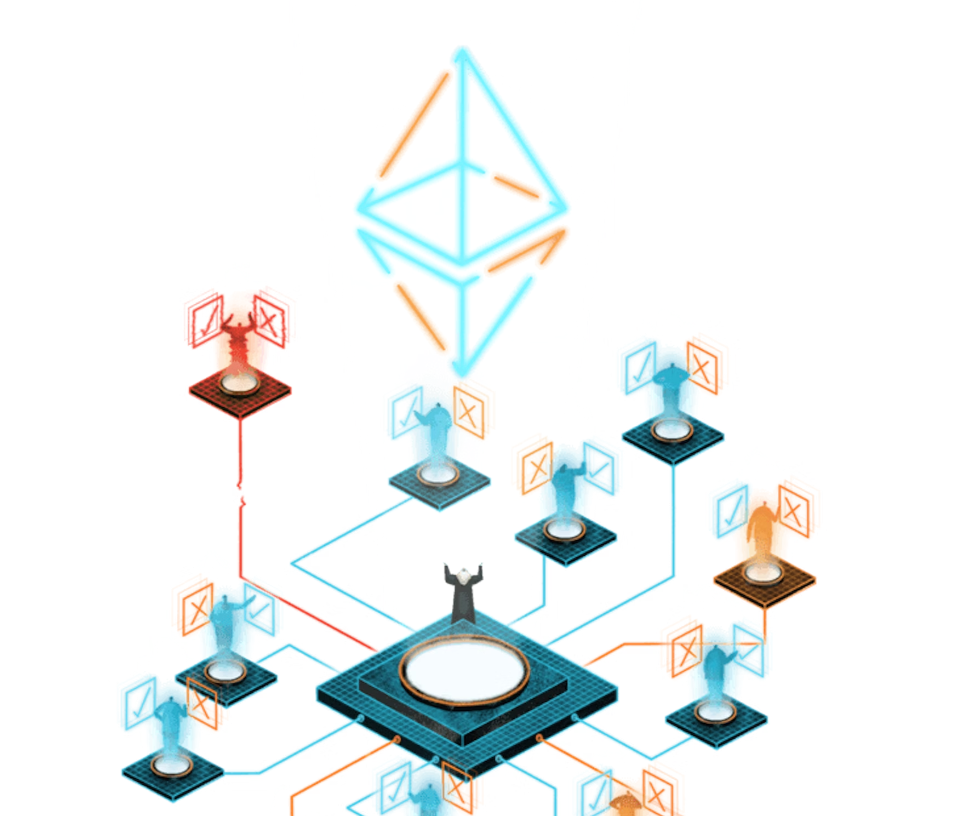

Is Ethereum’s Latest Rally a Setup for Disaster? Learn How Leverage is Spiking Volatility!

In the dynamic world of cryptocurrency, Ethereum has once again captured headlines, soaring to new heights at $4,886, tantalizingly close to the elusive $5,000 mark. This rally marks a significant phase for Ethereum as it ventures into previously uncharted financial terrain. Despite this robust performance, the market stands at a critical juncture, teetering between potential expansion and correction. This uncertainty is heavily tied to the increased speculative activity, with Ethereum’s price movements now sharply reacting to leveraged trades in the derivatives market rather than traditional, spot market demand.

The Leverage Factor: A Double-Edged Sword

According to insights from CryptoQuant, the so-called Leverage-Driven Pump indicator has triggered six times this month, signaling that much of the price movement is not organically driven. Historically, such scenarios have led to highly volatile market reactions—some prices have retracted as quickly as they have surged, while others have sustained a bit longer before showing signs of fatigue. As we delve deeper into these leverage-induced rallies, the question arises: are we setting up for a sustainable breakthrough above $5,000, or is this a precursor to a sharp pullback?

Underpinning Fundamentals Amid Speculative Frenzy

Despite the looming risks of short-term volatility due to leverage, the fundamental outlook for Ethereum remains bullish. Breaking past its 2021 peak, Ethereum is seeing significant institutional interest, with substantial acquisitions by entities like BitMine and SharpLink Gaming. Such robust demand is not only locking up supply but also fostering a scarcity that could well support higher prices if this institutional behavior continues. Moreover, the ongoing reduction in Ethereum’s availability on centralized exchanges further underscores a shift towards long-term holding strategies, traditionally a bullish signal.

Daily Trading Dynamics and Investor Sentiment

The daily trading chart for Ethereum shows a price of $4,771, maintaining a steady climb amidst market fluctuations. The presence of higher highs and higher lows since mid-July suggests a strong bullish trend, supported by a significant gap between the current price and moving averages. However, the market’s overextension in the short run and the recent price dip to just below $4,200, which quickly rebounded, indicate that while the buyer’s sentiment is strong, caution remains due to possible over-leveraging.

Looking Ahead: Strategic Points to Watch

As Ethereum hovers near the $5,000 threshold, the market’s next moves will be crucial. Traders are advised to look for sustained closes above $4,800 as a confirmation of continuing bullish trends. Conversely, a drop below key support levels like $4,500 could signal a deeper correction, potentially exacerbated by the unwinding of leveraged positions. For those keen on exploring more about Ethereum’s trajectory and its impact on the broader crypto market, visiting cryptocurrency news sections can provide deeper insights. Additionally, for real-time trading and investment opportunities, platforms like Binance offer extensive resources.

As Ethereum tests new grounds, both risks and opportunities lie ahead. Whether this turns into a landmark rally or a cautionary tale will depend significantly on how the interplay between speculative leverage and solid fundamentals unfolds in the near term.

Comments are closed.