$SPY $DXY #FederalReserve #RateCut #Inflation #EconomicPolicy #InterestRates #FedDecision #MarketTrends #USPolicy #FinancialMarkets

Will the Imminent Rate Cut Save You Money? Discover What 99.9% Odds Mean for Your Wallet!

In the realm of financial markets, the anticipation surrounding the Federal Reserve’s next move is palpable. As the September 16–17 policy meeting approaches, the consensus is overwhelmingly in favor of an interest rate reduction. The odds news is that traders, utilizing the CME Group’s FedWatch tool, now forecast a 99.9% likelihood of a quarter-point rate cut. This comes after the latest U.S. inflation data and ongoing calls from political spheres for more assertive monetary action.

Understanding the Impact of a Rate Cut

Interest rate decisions by the Federal Reserve can ripple across the economy, influencing everything from your mortgage rates to the returns on your savings accounts. If the Fed does reduce rates, borrowing costs could decrease, potentially stimulating more spending and investment. However, for savers, lower interest rates might translate to modest yields on bank savings and fixed-income investments.

The Fed’s Delicate Balancing Act

Despite the market’s strong expectation of a rate cut, there is an undercurrent of caution within the Federal Reserve. The central bank is tasked with navigating not only economic data but also external pressures and internal dissent. The decision to lower rates, although seen as a boost for economic activity, carries the risk of inflating asset bubbles and decreasing the efficacy of future monetary policy tools.

Market Reactions and Long-Term Implications

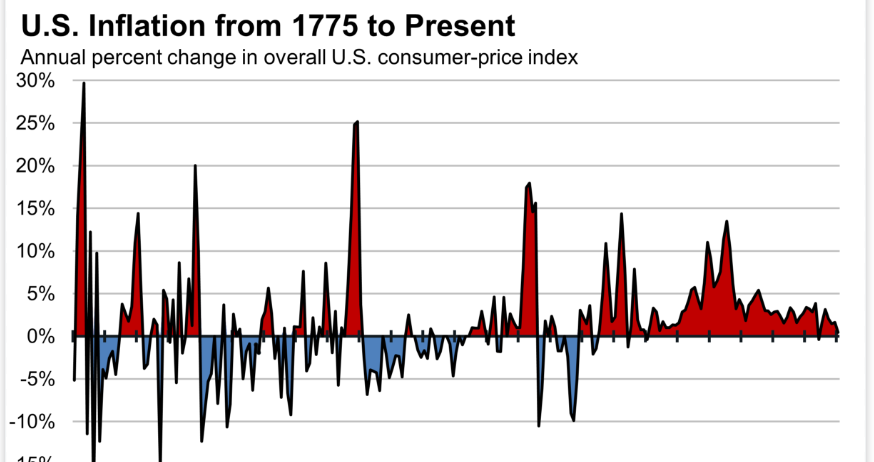

Investors and policymakers alike are tethered to the actions of the Federal Reserve. A rate cut could potentially elevate stock markets, as lower interest rates make bonds less attractive and stocks more appealing. However, the long-term effects require careful consideration. There’s an inherent tension between stimulating the economy in the short term and maintaining sustainable growth rates without undue inflation.

What This Means for Your Wallet

For individuals, the direct impact of a rate cut could be mixed. On one hand, if you’re looking to borrow—be it for a home mortgage or a business loan—lower interest rates could make this more feasible. On the other hand, if you rely on income from savings or fixed-income investments, the potential decrease in interest earnings could be a concern.

Preparing for Economic Shifts

As we edge closer to the Federal Reserve’s decision, it’s prudent for consumers and investors to prepare for shifts in the economic landscape. Understanding your financial exposure to interest rate changes can help you mitigate risks and capitalize on opportunities. For more detailed insights into how these developments affect the stock market, you can explore further on Financier News.

Conclusion: Navigating Uncertain Waters

The nearly unanimous market bet on a Federal Reserve rate cut reflects broader economic currents and the delicate interplay of global and domestic factors. As individuals and investors look to the future, staying informed and agile will be key to navigating these uncertain financial waters. Whether the imminent rate cut will save you money depends on a multitude of factors, but what remains clear is that the economic implications are wide-reaching and significant.

Comments are closed.