$BRK.B $AAPL #WarrenBuffett #InvestmentTips #StockMarket #ValueInvesting #LongTermInvest #FinancialFreedom #WealthBuilding #MarketWatch

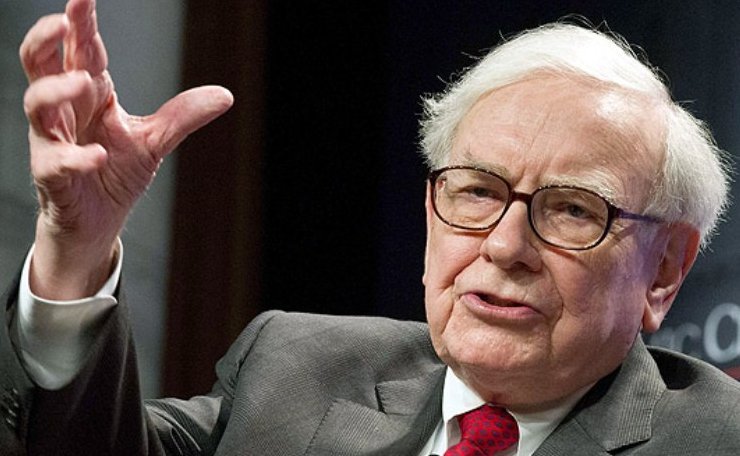

Want to Invest Like Warren Buffett? Discover 5 Stocks You Should Buy Today!

In the realm of investing, few names resonate as powerfully as Warren Buffett. This legendary investor has consistently outperformed the market, turning his keen analytical skills into substantial wealth not only for himself but for countless others who follow his strategies. Today, we delve into 5 no-brainer stocks that mirror Buffett’s investment philosophy, promising robust returns for those looking to build a durable portfolio.

Understanding Buffett’s Investment Strategy

Before jumping into the specific stocks, it’s crucial to grasp the core principles that guide Buffett’s selections. He favors companies with strong brand recognition, solid management teams, and clear competitive advantages. Furthermore, Buffett is renowned for his preference for undervalued stocks, those that the market has overlooked but have strong fundamentals and growth potential.

Top 5 Stocks to Consider for Your Portfolio

1. Apple Inc. (AAPL) – A Tech Titan with Consistent Growth

Apple has been a staple in Buffett’s portfolio, thanks to its innovative edge and consistent revenue growth. The company’s ability to retain consumer loyalty and its ventures into new tech frontiers like artificial intelligence and augmented reality make it a compelling pick for long-term investors.

2. Bank of America (BAC) – A Financial Behemoth with Strong Fundamentals

As one of the largest banks in the United States, Bank of America benefits from an expansive network and diverse financial services. Its growth in digital banking and cost management strategies are exactly what Buffett looks for in a resilient investment.

3. Coca-Cola (KO) – Beverage Giant with Global Reach

Coca-Cola’s global brand recognition and extensive distribution network underscore its position as a top pick for investors seeking stable dividend-paying stocks. Its commitment to expanding its product portfolio aligns well with evolving consumer preferences, ensuring long-term relevance.

4. Kraft Heinz (KHC) – A Food Industry Leader Focused on Innovation

Kraft Heinz, another Buffett favorite, reflects his strategy of investing in companies with the potential for turnaround and restructuring. Despite past challenges, the company’s focus on innovation and market adaptation positions it well for recovery and growth.

5. Amazon.com Inc. (AMZN) – E-Commerce Pioneer Poised for Expansion

Although a relatively newer addition to Buffett’s portfolio, Amazon’s dominant position in e-commerce and its forays into cloud computing and media services make it an attractive investment for those looking at future technologies and market expansion.

Why These Stocks Stand Out

Each of these companies exhibits characteristics that Buffett cherishes—strong brand equity, leadership in their respective sectors, and robust financial health. Moreover, they offer the potential for sustainable growth, a key aspect for any investor looking to emulate Buffett’s success.

Final Thoughts: Building a Buffett-Inspired Portfolio

Choosing to invest in these stocks is more than just following Buffett; it’s about recognizing value and potential where others might not. For further insights into building a successful investment portfolio, consider exploring more articles at Financier News.

Remember, investing like Buffett also means adopting his patient, long-term approach to wealth accumulation. It’s not just about picking stocks but also about cultivating a disciplined investment philosophy. Whether you’re new to the stock market or looking to refine your strategies, these 5 no-brainer picks provide a solid foundation for achieving your financial goals.

Comments are closed.