$KO #WarrenBuffett #BerkshireHathaway #CocaCola #Investing #StockMarket #LongTermInvestment #ValueInvesting #DividendStocks #FinancialFreedom #WealthBuilding

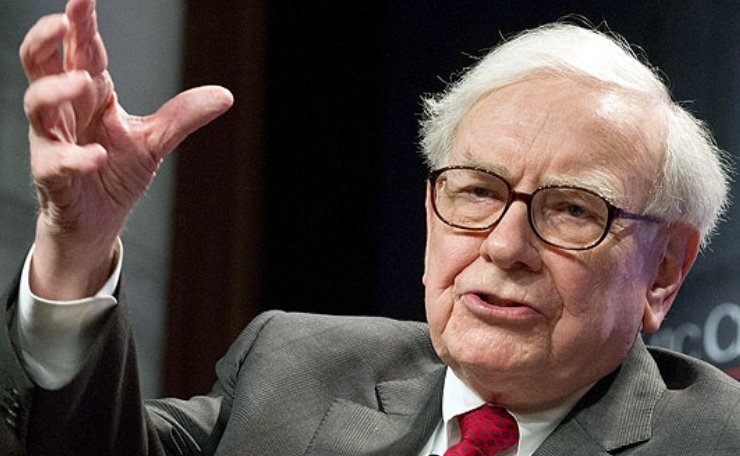

Which 3 Warren Buffett Stocks Should You Own for Life? Discover Now!

In today’s financial landscape, identifying stocks with enduring value and robust growth potential is crucial. Among these, three stocks stand out, backed by none other than investment mogul Warren Buffett. Diving into these selections, we see why they’re poised to be cornerstone investments in any portfolio. Our focus today revolves around the ever-reliable Coca-Cola, alongside two other stalwarts in Buffett’s arsenal.

Coca-Cola: A Refreshing Staple in Buffett’s Portfolio

Coca-Cola, represented in the market by its ticker $KO, has evolved into one of Berkshire Hathaway’s pivotal investments. This iconic beverage leader not only boasts a global brand recognition but also demonstrates a compelling history of stable dividends and resilient market performance. The company’s strategy of diversifying its beverage portfolio while maintaining strong global distribution channels underscores its capacity to manage through various market cycles. For a deeper insight into Buffett’s strategy with stocks like Coca-Cola, explore more on our dedicated stock news section.

Why Coca-Cola Holds a Perpetual Appeal

The appeal of Coca-Cola in Buffett’s portfolio can be attributed to its consistent dividend payouts and strong brand equity. These factors make it an attractive option for investors seeking long-term, stable returns. Furthermore, Coca-Cola’s ability to adapt to changing consumer tastes with new product lines and healthier options reinforces its market position and future growth trajectory.

Exploring the Other Two Buffett Favorites

Transitioning from beverages to broader market sectors, the other two stocks that complete our list of Buffett must-haves include a major financial institution known for its robust fiscal management and a tech giant that has recently focused on sustainability and innovation. Both companies align with Buffett’s investment philosophy, which prioritizes strong leadership, solid profit margins, and a proven track record of growth.

Investment Strategies for the Long Haul

Investing in stocks like those favored by Warren Buffett requires a mindset geared towards long-term gains. It’s not just about the immediate returns but understanding the intrinsic value these companies bring. They are not merely stocks but enterprises that have stood the test of time, demonstrating resilience and adapting to economic shifts.

Conclusion: Building a Diverse and Resilient Portfolio

Incorporating these three stocks into your investment portfolio could offer not just diversity but also a sense of security, knowing that you are investing in companies with a longstanding history of success and stability. Whether you’re a seasoned investor or just starting out, these picks provide a foundation for building wealth that can withstand the ebbs and flows of the market.

Remember, the key to successful investing lies in choosing stocks that offer not only good returns but also align with your financial goals and risk tolerance. By emulating investment giants like Buffett, one can learn the art of selecting stocks that offer potential for significant financial rewards over time. For more insights into smart investing and financial strategies, keep up with our latest articles on Financier News.

Comments are closed.