$BRK-A $BRK-B #WarrenBuffett #BerkshireHathaway #StockMarket #InvestmentTrends #FinanceNews #MarketAnalysis #InvestorInsight #BuffettPremium #StockValue

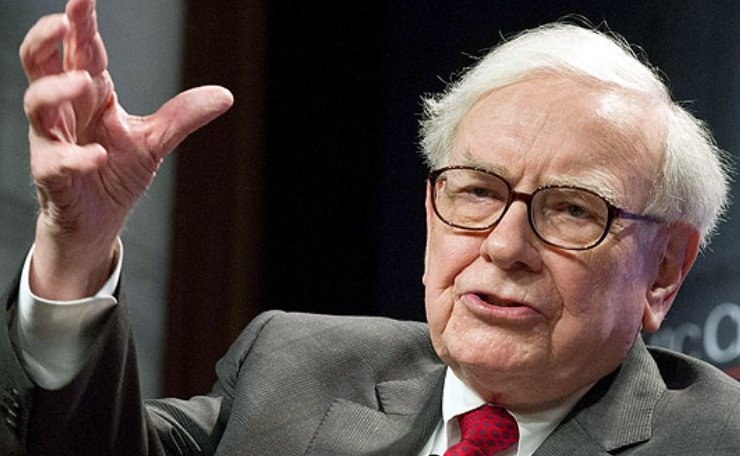

Is Warren Buffett’s Retirement Dimming Berkshire Hathaway’s Stock Shine? Learn What This Means for Investors.

In recent financial updates, it appears that Berkshire Hathaway Inc. (NYSE: BRK-A) (NYSE: BRK-B), once buoyed by the so-called “Buffett premium,” is now seeing a shift in its market appeal. Analysts suggest that the imminent retirement of Warren Buffett, the legendary investor and CEO, is casting a long shadow over the company’s stock performance.

Understanding the Buffett Premium

Historically, Berkshire Hathaway’s stock has enjoyed a robust valuation, thanks in large part to Warren Buffett’s stellar reputation and investment prowess. This “Buffett premium” essentially factored in the added value brought by Buffett’s leadership. Now, with rumors of his retirement, there’s a growing sense of uncertainty among investors.

Market Reactions and Investor Sentiments

The speculation surrounding Buffett’s retirement has led to a cautious approach from investors. Market watchers are keenly observing the potential shifts in management strategy and its implications for future growth. This wariness is reflected in the company’s recent stock performance, which has not shown the bullish trends typical of past years.

Future Prospects for Berkshire Hathaway

As Berkshire Hathaway faces a new era, questions arise about the sustainability of its investment appeal without Buffett at the helm. This transition period is critical, and the company’s ability to maintain its market position will heavily depend on the strategic decisions of the next leadership team.

Investor Strategies Moving Forward

For investors, the changing dynamics at Berkshire Hathaway warrant a revised approach. Analyzing the company’s long-term strategy and its alignment with current market conditions becomes paramount. Moreover, diversifying investments to mitigate risks associated with the leadership transition could be a prudent strategy.

For those looking to explore more about stock trends and investment opportunities, you can find detailed analyses at Financier News.

The Bottom Line

Warren Buffett’s potential retirement might be diminishing the unique stock value advantage that Berkshire Hathaway has long enjoyed. Investors should remain alert to the developments and adjust their investment strategies accordingly. This period of transition offers both challenges and opportunities, making it essential for stakeholders to stay informed and adaptive.

Comments are closed.