$BTC #Bitcoin #CryptoMarket #SupplyShock #DigitalCurrency #Blockchain #Investment #MarketTrends #FinanceNews #Cryptocurrency

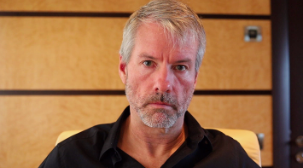

As Michael Saylor continues to aggressively accumulate Bitcoin, concerns are rising about a potential supply shock within the cryptocurrency market. This strategic buying spree, led by Saylor and other significant investors, is rapidly diminishing the available supply of Bitcoin, setting the stage for what could be a historic shift in its market dynamics.

Michael Saylor, the CEO of MicroStrategy, has become synonymous with large-scale Bitcoin acquisitions, advocating for Bitcoin as a preferable store of value over traditional assets like gold. His firm’s relentless purchasing of Bitcoin has not only bolstered their reserves but has also sent ripples across the financial landscape, prompting both individual and institutional investors to reconsider Bitcoin’s role in their portfolios.

The concept of a “supply shock” in the context of Bitcoin arises when the available supply of the cryptocurrency is sharply reduced. Historically, decreases in supply with steady or increasing demand have led to price increases. In Bitcoin’s case, this supply constraint is further exacerbated by its capped limit of 21 million coins, of which about 18.9 million are already in circulation.

Market analysts are closely watching these developments, predicting that continued buying at this rate could significantly impact Bitcoin’s liquidity. This scenario typically leads to a bullish market behavior, as the reduced supply may help drive up the price due to the increased competition for the remaining coins.

Furthermore, the broader implications of such a supply shock could extend beyond mere price appreciation. A significant reduction in Bitcoin’s liquidity could enhance its volatility, affecting the stability and attractiveness of Bitcoin as a digital asset. Investors, particularly those new to the cryptocurrency market, should remain vigilant about these dynamics, as they could influence not only investment returns but also the risk associated with Bitcoin investments.

In conclusion, Michael Saylor’s strategic bulk buying of Bitcoin might be setting the stage for a supply shock. While this could potentially lead to higher prices and increased investor interest, it also underscores the need for careful market analysis and risk assessment. As the landscape of digital currencies continues to evolve, the actions of influential market players like Saylor will undoubtedly play a critical role in shaping its future.

Comments are closed.