$DJI $SPX $BTC

#FederalReserve #InterestRates #Trump #Elections #StockMarket #Economy #Investing #Crypto #Inflation #FOMC #MonetaryPolicy #WallStreet

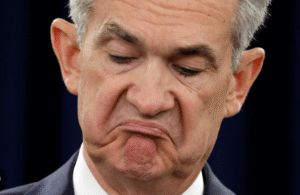

The Federal Reserve finds itself in an uncertain holding pattern as it assesses the potential economic implications of former President Donald Trump’s policies ahead of the upcoming election. With key elements of fiscal strategy, tax policy, and trade relations hanging in the balance, the central bank has refrained from making sweeping changes to its interest rate policy. Investors are closely watching the Fed’s every move, knowing that any shift in monetary policy could have ripple effects across equities, bonds, and even crypto markets. While inflation has shown signs of easing, Fed Chair Jerome Powell and other policymakers are wary of potential volatility driven by shifting political dynamics and global economic concerns. As a result, the Fed appears committed to a neutral stance, ensuring that it does not overreact to short-term market fluctuations.

Markets have responded with cautious optimism as some traders speculate that Trump’s potential return to the White House could lead to a more business-friendly environment with lower taxes and deregulation. The S&P 500 and Dow Jones Industrial Average have seen periods of volatility, while Bitcoin and other cryptocurrencies have remained sensitive to shifts in monetary expectations. However, the Fed’s reluctance to signal rate cuts or hikes has kept bond markets relatively stable, with Treasury yields maintaining a tight trading range. Despite persistent concerns about inflation and wage growth, the Fed is focused on maintaining a balanced approach that avoids derailing the progress made since the post-pandemic economic recovery. Analysts remain split on whether the central bank’s current policy stance is sustainable in the face of potential fiscal expansions or protectionist trade strategies under a second Trump administration.

Interest rates remain a crucial factor in market sentiment, with investors weighing the likelihood of future adjustments based on evolving economic indicators. If inflationary pressures resurface due to aggressive fiscal policies, the Fed may be forced to adopt a more hawkish stance, potentially dampening investor enthusiasm in growth sectors. Conversely, a slowdown in hiring or consumer spending could increase the prospect of rate cuts, fueling rallies in both equity and crypto markets. Global uncertainty, including geopolitical developments and energy market fluctuations, adds another layer of complexity to the Fed’s calculations. In this environment, the central bank’s wait-and-see approach appears prudent, but it also leaves room for heightened volatility should unexpected economic shifts occur.

For now, markets appear to be in a holding pattern much like the Fed itself, digesting data and awaiting clearer signals on the direction of fiscal and monetary policy. While the Fed remains steadfast in its commitment to price stability and full employment, external factors—including election-driven policy changes—could dramatically alter the economic landscape in the coming months. As Wall Street and global investors navigate this uncertainty, any Fed policy adjustments or hints at future moves will be scrutinized for their potential market impact. Whether the central bank remains in “neutral” for an extended period or is forced into action by macroeconomic shifts remains to be seen, but one thing is clear: financial markets will be watching closely.

Comments are closed.