$BRK.A $BRK.B $SPY

#BerkshireHathaway #WarrenBuffett #Investing #StockMarket #Finance #CashReserves #MarketAnalysis #WealthManagement #Economy #ValueInvesting #PassiveIncome #FinancialNews

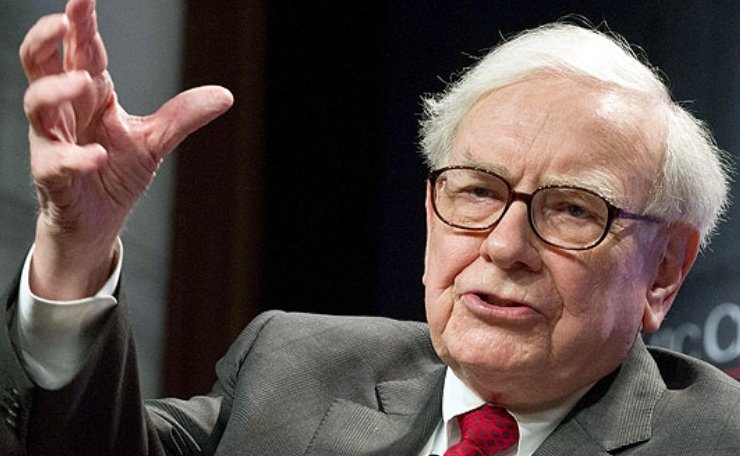

Warren Buffett has sought to reassure Berkshire Hathaway shareholders amid the company’s soaring cash reserves, a development that has sparked considerable discussion among investors and analysts. As of the latest financial reports, Berkshire Hathaway’s cash holdings have reached a record high, exceeding $167 billion. This massive liquidity position raises questions about Buffett’s investment strategy and the difficulty in identifying attractive opportunities in an increasingly expensive market. Traditionally, Buffett has leveraged periods of economic downturn to make significant acquisitions at favorable valuations, but in the current high-valuation environment, capital deployment has been more conservative.

Berkshire’s growing cash pile suggests that Buffett and his team are facing challenges in finding opportunities that meet their strict investment criteria, which prioritize businesses with strong fundamentals and reasonable valuations. The reluctance to invest aggressively could signal broader concerns about asset pricing across various sectors. Given inflated stock valuations, high interest rates, and geopolitical uncertainties, Buffett’s conservative stance implies a cautious outlook on short-term market conditions. Some investors welcome this discipline, seeing it as a safeguard against overpaying for assets, while others worry that the lack of major acquisitions could result in less efficient capital utilization.

Despite holding onto record levels of cash, Buffett emphasized that Berkshire Hathaway remains well-positioned for potential opportunities. The company has historically made strategic moves when market conditions shift, such as its timely investments during the 2008 financial crisis and its more recent energy sector acquisitions. While some might question the lack of recent large-scale deals, Berkshire’s flexibility ensures that the company can act decisively when valuations become more attractive. This approach underscores the firm’s commitment to long-term value creation rather than short-term speculation, reinforcing Buffett’s reputation as a disciplined investor.

Market analysts note that the sizable cash reserves could also provide Berkshire with considerable advantages in a downturn scenario. Should the market experience a correction or enter a period of economic uncertainty, Berkshire would be well-equipped to deploy capital into undervalued assets. Investors should closely monitor Buffett’s next moves, as any significant deployment of capital could provide insights into his outlook on market conditions. For now, his conservative approach signals patience and prudence amid an environment of high valuations and macroeconomic uncertainty. As Berkshire navigates these conditions, its ability to balance caution with opportunistic investments will be central to maintaining shareholder confidence.

Comments are closed.