$GOOGL $AAPL $AMZN

#Trump #Tariffs #BigTech #DigitalTax #TechStocks #Economy #US #EU #Trade #Regulation #Investing #StockMarket

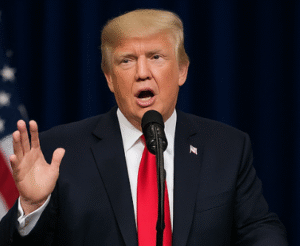

Former U.S. President Donald Trump is considering imposing tariffs as a countermeasure against digital services taxes levied by several countries on American technology giants. In response to growing tensions over international tax policies, Trump has ordered probes into the tariffs imposed by the European Union, the United Kingdom, and Turkey. These digital services taxes primarily target large U.S.-based companies like Alphabet ($GOOGL), Apple ($AAPL), and Amazon ($AMZN), which generate significant revenues from digital advertising and online services in foreign markets. The implementation of such tariffs could escalate trade disputes between the U.S. and its counterparts, potentially impacting the global technology sector.

The move reflects broader concerns about taxation fairness. The affected countries argue that major U.S. firms profit substantially from their consumers without contributing enough in local taxes. To address this, they have introduced digital services taxes ranging from 2% to 7.5% on revenues derived from online advertising, e-commerce platforms, and digital content. While these policies are largely seen as a means to ensure fair taxation, the U.S. views them as discriminatory, prompting the Trump administration’s inquiry into whether retaliatory tariffs would be justified. Market analysts suggest that potential U.S. levies on European goods and services could dampen investor sentiment toward affected sectors, including tech, manufacturing, and consumer goods.

If Trump proceeds with tariffs, investors should brace for increased volatility in tech stocks. Alphabet, Apple, and Amazon—companies already scrutinized for their global operations—could see short-term stock price fluctuations in response to policy developments. Tariffs could drive up operational costs for these firms, which might lead to higher prices for consumers or margin squeezes for the companies. Additionally, heightened geopolitical tensions could lead to risk-off sentiment in broader equity markets, pushing investors toward defensive stocks and safe-haven assets like bonds and gold. Given that the U.S. stock market has shown sensitivity to trade policy uncertainty in the past, this latest development could spark retaliatory measures from foreign governments, further complicating the global trade landscape.

Beyond financial market impacts, there are wider economic implications. If tariffs escalate into full-scale trade disputes, it could weaken international cooperation on tax standards, affecting future negotiations at the OECD level. Policymakers have been working toward a global minimum tax framework to prevent unilateral digital levies, but U.S. retaliation might hinder these efforts. Additionally, American consumers and businesses relying on imports from Europe and Turkey may face higher costs due to retaliatory tariffs from these countries. While some argue that strong U.S. action is necessary to protect domestic corporations, others warn that escalating tensions could disrupt trade flows and slow economic growth. Investors, policymakers, and executives will be closely watching for the administration’s next moves as discussions on digital services taxation continue to unfold.

Comments are closed.