$DJIA $SPY $BTC

#TrumpOrganization #DonaldTrump #EthicsPlan #FamilyBusiness #TrumpPresidency #FinanceNews #CorporateGovernance #MarketImpact #PoliticalNews #BusinessEthics #NASDAQ #StockMarket

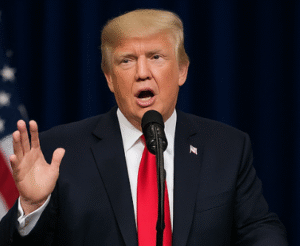

The Trump Organization recently unveiled an ethics plan designed to distance President-Elect Donald Trump from the company’s daily operations, addressing concerns raised during his transition to the White House. The move is part of a broader effort to alleviate conflicts of interest, as Trump takes on his role as President of the United States. By stepping away from the management of his extensive business empire, he aims to ensure that policy-making at the federal level is not perceived as being influenced by his personal financial interests. This development has drawn attention to corporate governance practices and the challenges of maintaining ethical boundaries when political figures have significant commercial holdings.

From a market perspective, the announcement has broader implications, given the Trump Organization’s expansive reach in real estate, hospitality, and branding. While privately held companies like the Trump Organization do not directly impact the stock market, the perceived ethical commitment could resonate positively with publicly traded companies emphasizing corporate governance. Markets may interpret this move as an effort to mitigate potential risks in regulatory policies caused by overlapping business and political affiliations, which can impact stock indexes such as $DJIA and $SPY. For investors in Wall Street, reassurance of separation between politics and private interests could reduce uncertainty that often disrupts market sentiment.

Although this ethics plan may placate some critics, skeptics argue that the measures do not go far enough. Critics emphasize that ownership, not just operational control, ties Trump to the success of his businesses. Analysts expect continued calls for increased transparency, such as divestiture of assets or establishment of a blind trust. From a governance perspective, these potential calls could set benchmarks for future cases where business leaders enter significant political roles. For the crypto space, discussions around the ethics of decentralized finance ($BTC) have become more relevant as scrutiny of financial conflicts escalates, and blockchain technology could offer solutions to financial transparency.

The unveiling of this ethics plan also provides a closer look at the dynamics between politics and business. It emphasizes that economic ecosystems, whether tied to real estate, equity markets, or currency, remain sensitive to the confidence in governance and perceived ethical integrity. While the long-term impact remains uncertain, the announcement is a reminder of the balancing act individuals in influential positions must maintain. For now, investors and regulators alike will closely observe how Trump and his organization navigate these complexities to craft a model of governance that avoids undermining either the political or financial domains. This evolving scenario could create new case studies in ethical decision-making for future leaders.

Comments are closed.