$SNCAF $HKG50

#China #RealEstate #Sunac #HongKong #StockMarket #DebtCrisis #PropertyBubble #EmergingMarkets #CreditRisk #Investments #FinancialNews #EconomicSlowdown

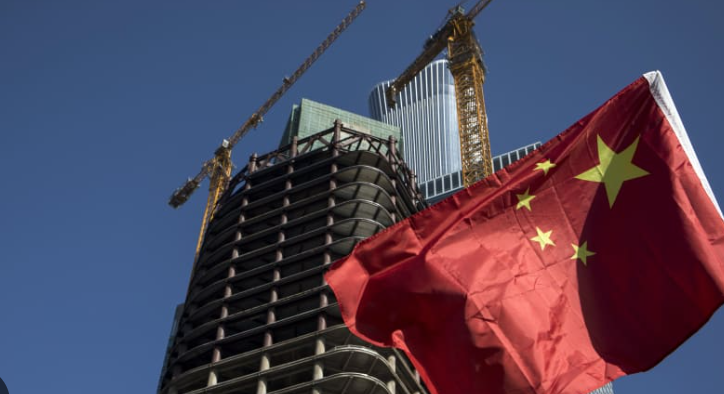

Shares of Chinese property developer Sunac China Holdings have plummeted 26% following the revelation that a winding-up petition has been filed against the company in Hong Kong. The news sent shockwaves through financial markets and reignited concerns over the mounting debt crisis within China’s embattled real estate sector. The petition marks yet another setback for Sunac, which has been striving to stabilize its financial position amid a challenging environment for property developers in the region. The sharp stock selloff reflects a significant erosion of market confidence in the company’s ability to navigate this unfolding crisis.

The developer disclosed the liquidation petition publicly, raising questions about its liquidity and solvency. This unfolding event comes as part of a larger crisis gripping China’s real estate market, where high-profile developers like Evergrande have already defaulted on their obligations. Investors fear that Sunac could follow a similar path, particularly as its struggles are emblematic of deeper structural issues within the sector. The company had already undergone debt restructuring talks as part of efforts to avert a more severe financial fallout. However, this latest development suggests that these efforts may have been insufficient, fueling concerns of further contagion across the broader property market.

The implications extend beyond Sunac itself, as the potential liquidation could have ripple effects for the Chinese property sector, which accounts for roughly one-quarter of the country’s GDP. Such a major disruption risks exacerbating the credit crunch affecting other developers, particularly smaller players without substantial financial reserves. The broader market impact was visible as the Hang Seng Index, a benchmark for Hong Kong stocks, dipped following the news. This reflects heightened investor caution about exposure to the real estate sector and, by extension, the Chinese economy as a whole. As market participants assess the potential damage, questions arise about whether policymakers in Beijing might step in with additional measures to stabilize the sector.

Sunac’s predicament also highlights the growing risks for investors in Chinese equities in general. Foreign capital—which accounts for significant investments in China’s property bonds and stocks—appears increasingly jittery, fearing the domino effects of further defaults. Credit rating agencies may begin reassessing the risk profiles of other developers in light of this situation, which could trigger tighter lending conditions and exacerbate liquidity challenges for the sector. Meanwhile, traders are advised to monitor developments closely as renewed volatility may present both risks and opportunities in emerging markets. The Sunac liquidation petition is a stark reminder of the fragility permeating the Chinese housing market and its potential to disrupt global financial systems.

Comments are closed.