$LMT $RTX $NOC

#Israel #ArmsDeal #Biden #GlobalSecurity #DefenseSector #StockMarket #MiddleEast #Geopolitics #USPolicy #DefenseStocks #MilitarySpending #MarketImpact

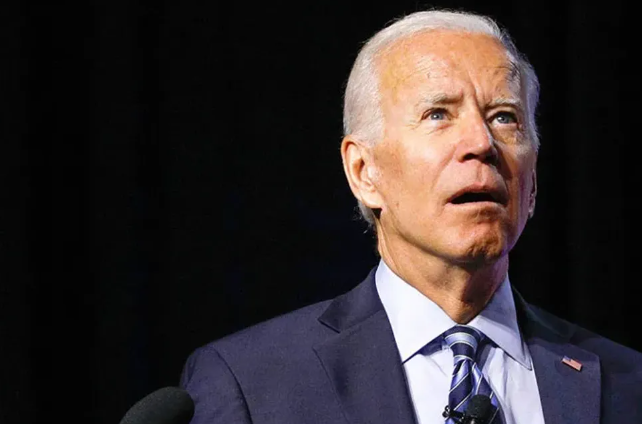

President Biden has proposed an $8 billion arms deal with Israel during his outgoing administration, marking one of the most significant military aid packages in recent history. This proposal underscores the importance of U.S.-Israel relations amid escalating tensions in the Middle East, particularly following the Gaza conflict in 2023. Central to the agreement are advanced weapons systems, including bombs and precision-guided munitions designed to bolster Israel’s defense capabilities. The deal, if approved, is expected to reinforce the already robust U.S. defense alliance with Israel while reigniting debates over the U.S.’s role in global security and involvement in regional conflicts.

Defense contractors like Lockheed Martin ($LMT), Raytheon Technologies ($RTX), and Northrop Grumman ($NOC) could directly benefit from this deal. These companies have historically supplied advanced defense hardware to Israel and other allies. Investors may see heightened activity in defense stocks, as substantial arms deals often translate into longer-term revenue streams for these firms. For example, military-grade technologies, weapons guidance systems, and aerospace innovations produced by these giants could see increased demand. Furthermore, as geopolitical tensions continue to drive national security budgets upward, defense stocks could serve as a safe haven for investors looking to hedge against broader market volatility. Analysts also predict that if the deal is finalized, these stocks may see a short-term surge due to contracts linked directly to Israel’s military needs.

On the geopolitical front, this deal has significant ramifications for the U.S.’s standing in the region and its relationships with other Middle Eastern nations. Critics of the arms sale argue that such deals may exacerbate underlying hostilities, particularly with Iran and non-state militant groups. However, proponents suggest that aiding Israel via advanced military capabilities strengthens a key ally in deterring aggression. Economically, the deal further cements the U.S. defense sector’s role as a global leader in arms exports, with Israel continuing to be one of its most significant buyers. At the same time, some analysts caution that the price tag of $8 billion, coming at a time of rising federal deficits and U.S. domestic issues, may provoke opposition within Congress and among voters concerned about fiscal responsibility.

For Israel, the financial and strategic boost could mean improved security infrastructure with the acquisition of new tools to counter emerging threats. The deal may also encourage other nations, particularly in the Middle East, to reassess their military expenditures and alliances. For the cryptocurrency sector, no direct link to this arms deal is apparent. However, with escalating tensions, cryptocurrencies like Bitcoin and Ethereum have historically acted as alternative stores of value, particularly during periods of geopolitical uncertainty. Investors may also observe an indirect influence as heightened global tensions increasingly correlate with crypto market movements. Financial markets are expected to respond as details of the deal emerge and as this high-profile proposal garners scrutiny and debate.

Comments are closed.