$DJI $SPY $BTC

#Trump #Sentencing #DonaldTrump #Politics #USPresident #FinancialImpact #Markets #Investors #Crypto #Stocks #LegalNews #Economy

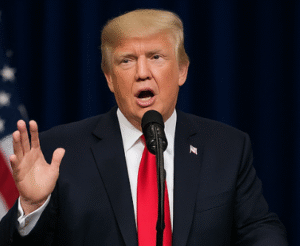

Former U.S. President Donald Trump has made history as the first American leader to ever be convicted of a crime while holding or having held the nation’s highest office. This unprecedented development, which comes as Trump’s sentencing is set for January 10, has stirred debates across legal, political, and financial sectors. As reports indicate the judge is leaning towards no jail time, no probation, or fines, the market’s reaction has been muted but not completely indifferent to the possible long-term repercussions.

From a financial markets perspective, stability in the political landscape is a key factor for investor confidence. While Trump is no longer in office, his continued influence on U.S. politics and his role as a central figure in the Republican Party add layers of complexity. Market indices like $SPY (S&P 500 ETF) and $DJI (Dow Jones Industrial Average) have so far shown negligible reactions to the news, but it’s worth noting that prolonged uncertainty surrounding high-profile political events occasionally fosters underlying volatility. In times of political intrigue or instability, investors often flock to safe-haven assets like gold, U.S. Treasury bonds, or even cryptocurrencies like $BTC.

This case also poses questions about its broader implications for governance and regulatory policies. As Trump retains considerable sway over certain sectors and industries, such as energy and real estate, any political fallout could reflect back into these markets. For instance, companies closely aligned with GOP-led policy initiatives might see some investor hesitation, while others could benefit from reduced political overhang. Crypto markets, which often react sharply to shifts in macroeconomic trends or legal frameworks, appear stable for now, though speculative fluctuations can’t be ruled out.

The January sentencing could mark a pivotal moment not just in history but also in market psychology. While the judge’s inclination toward leniency might mitigate immediate financial impact, the long-term effects hinge on broader aspects such as public sentiment, Trump’s political future, and potential economic policy shifts. Market participants will likely keep a close eye on upcoming developments, balancing sentiment with strategic allocation of assets to navigate any potential headwinds.

Comments are closed.