$TSLA $NEE $BTC

#Biden #Trump #ClimateChange #ParisAgreement #Emissions #RenewableEnergy #CleanEnergy #GreenInvesting #CarbonNeutral #NetZero #Sustainability #EnergyTransition

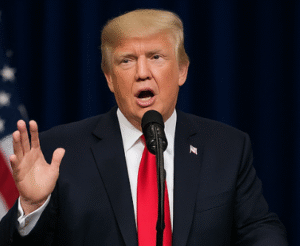

A month before President-elect Donald Trump’s return to the White House, the Biden administration has announced an ambitious plan to reduce the U.S.’s net greenhouse emissions by 61% to 66% below 2005 levels by 2035. This pledge forms part of the U.S. Nationally Determined Contribution (NDC) under the Paris Agreement, a global accord aimed at combating climate change. President Biden’s commitment aims to solidify the U.S. position on climate leadership as he nears the end of his presidency. However, the impending transition of power to Trump raises concerns among climate advocates and the markets, given Trump’s prior decision to withdraw the U.S. from the Paris Agreement during his first term. Financial markets are already pricing in uncertainty as renewable energy stocks have seen increased volatility in recent days, reflecting concerns about potential policy reversals under a Trump administration.

Renewable energy leaders such as $TSLA (Tesla) and utility giants like $NEE (NextEra Energy) could face significant headwinds if a Trump administration were to roll back incentives for clean energy development. During Biden’s presidency, renewable energy investments surged as the U.S. government worked aggressively to subsidize clean technologies and phase out fossil fuel dependence. The announcement of such a bold emissions-reduction target aligns with recent global trends of portfolio shifts toward sustainability and ESG-focused investment strategies. However, with the political uncertainty surrounding Trump’s repeated critiques of green policies, these stocks may experience near-term downward pressure as investors hedge against a likely policy shift. The broader market impact of Biden’s announcement is also noticeable in the commodities sector, where oil prices have been steadily rising under the expectation that a potential loosening of climate regulations could benefit fossil fuel production.

Crypto markets may also feel the weight of this policy shift, particularly as cryptocurrencies like $BTC (Bitcoin) face growing scrutiny over their environmental impact due to energy-intensive mining. Should Trump adopt a pro-fossil-fuel stance that downplays renewable energy priorities, the currently emerging trend of blockchain projects integrating carbon offset mechanisms could slow. Bitcoin and other energy-intensive blockchain technologies may find a less conducive environment under Trump, especially if regulatory bodies dial back their focus on climate-related financial disclosures. On the other hand, if Biden’s pledge successfully drives meaningful progress in global climate cooperation before his term ends, this could spur renewed interest in energy-efficient cryptocurrencies and blockchain platforms, benefiting the sector in the long term.

The geopolitical implications of Biden’s climate strategy and Trump’s potential counter-policies could define the U.S.’s financial and environmental influence globally. Companies and investors will likely keep an eye on international reactions, as it may influence cross-border green investments between the U.S., Europe, and Asia. For global renewables and sustainability-focused ETFs, Biden’s commitment offers optimism in the short term. However, the looming Trump presidency injects a high degree of uncertainty, warranting caution in longer-term investment plans involving clean energy. As political transitions unfold, the market awaits further clarity on regulatory landscapes and funding priorities, both domestically and globally, which could have lasting effects across financial sectors.

Comments are closed.