$TWTR $SPY $BTC

#DonaldTrump #HushMoney #LegalNews #Sentencing #USMarkets #CryptoNews #Stocks #WallStreet #Investing #PoliticalRisk #MarketSentiment #Regulations

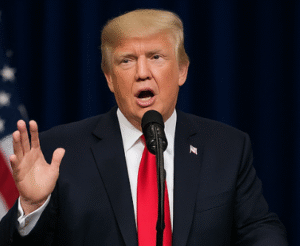

A New York judge has made the decision to indefinitely defer the sentencing of former President Donald Trump in his criminal hush money case. The case stems from allegations that Trump directed payments to silence individuals during his 2016 presidential campaign to avoid damaging his public image. While Trump’s legal matters remain a subject of intense public and political scrutiny, the delay in sentencing is raising questions about the broader implications for financial markets, regulatory oversight, and the political landscape ahead of the 2024 elections.

Financial markets have historically reacted to political uncertainty and legal developments involving high-profile figures. Political risk often translates to shifts in investor sentiment, with potential impacts on equities, traditional safe-haven assets, and even volatile cryptocurrencies. For example, the broader S&P 500 index ($SPY) could see higher volatility as traders assess whether Trump’s ongoing legal issues may affect Republican dynamics in Congress or future regulatory stances toward corporations and financial markets. Sentiment-sensitive assets, like $BTC, might experience speculative activity, as crypto traders monitor whether U.S. regulatory rhetoric intensifies amid heightened political controversies.

The delay extends a lingering cloud of uncertainty that markets dislike, but it’s not just U.S. assets that could be affected. Depending on the legal trajectory, there could be spillover effects internationally, particularly among countries that closely track U.S. leadership stability for trade or diplomatic reasons. The announcement of the postponement also coincides with rising political polarization in the United States, which can exacerbate other economic pressures, such as inflationary shifts or the Federal Reserve’s monetary policy decisions. These factors collectively underscore how political developments, like Trump’s case, often feed directly into investor decision-making processes.

Looking ahead, investors may begin to factor in potential 2024 election scenarios. A resurgence in Trump’s political standing could suggest heightened regulatory scrutiny for sectors such as tech and finance, where his administration previously had a complex relationship. Moreover, his ties to social media platforms, such as those linked to $TWTR, could also come back into focus. Traders will likely pay close attention to upcoming developments in this case, along with the broader political fallout, to better determine how best to position portfolios in this period of legal and market ambiguity.

Comments are closed.