$LMT $BA $RTY

#Biden #Ukraine #Russia #Missiles #USDefense #ECB #Banking #CapitalRequirements #G20 #Brazil #EuropeEconomy #MilitaryStocks

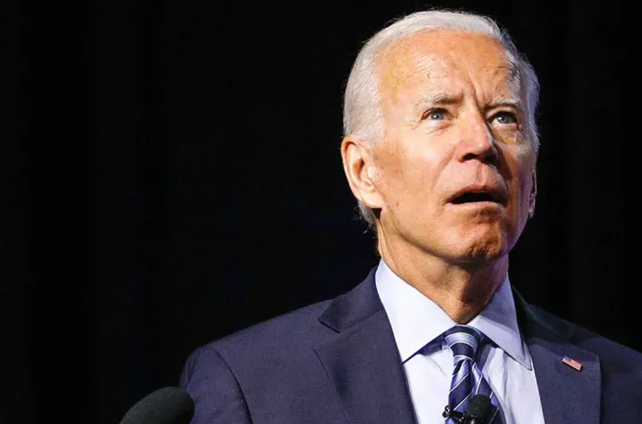

U.S. President Joe Biden has reportedly authorized Ukraine to use long-range U.S.-supplied missiles to strike targets within Russia, marking a significant escalation in the ongoing conflict between the two countries. This decision signals a more confrontational approach as Ukraine’s counteroffensive efforts continue in the face of sustained Russian aggression. This authorization could potentially put major U.S. defense contractors such as Lockheed Martin ($LMT) and Boeing ($BA) back in the spotlight, as further demand for advanced defense technology grows. Both stocks have previously seen material boosts when tensions in Eastern Europe flare up, largely due to increased budget allocations toward defense spending, which directly impacts revenue and profitability for manufacturers of advanced weaponry.

Given the dramatic escalation in military tactics, this move has the potential to affect market sentiment globally, particularly in industries related to defense, transportation, and technology services that could be disrupted by an intensifying conflict. Investors will likely keep a close eye on flight-to-safety assets such as gold or U.S. Treasuries, as market volatility spikes. Historically, geopolitical events of this nature have led to short-term market shock, which could drive safe-haven investments higher while weakening riskier assets. Additionally, emerging markets heavily reliant on energy exports like oil and gas could face further uncertainty, as sanctions against Russia have previously exacerbated global energy shortages, strengthening prices.

In parallel, today’s release of the European Central Bank (ECB) report on bank capital requirements highlights growing concerns regarding the stability of European banks. Higher inflation and geopolitical tensions may pressure the central bank to reinforce capital restrictions, which could directly influence lending practices and liquidity within the Eurozone. Investors are likely wary of reduced profitability for European banks if stricter regulations are implemented, which could affect their equity and bond issuances. Additionally, tightening capital requirements could also hamper the recovery efforts of European economies still grappling with inflationary headwinds.

As the G20 summit begins in Brazil, discussions surrounding energy resources, climate change, and global security are expected to be key issues. The summit provides a critical forum for the world’s largest economies to outline coordinated responses to these challenges. For investors, there will be a close focus on trade policies that could emerge from the summit, especially those related to green energy and technological investments. Any potential shifts in international trade dynamics resultant from the summit could ripple through global markets, affecting multinational corporations with diversified presences across trade-sensitive industries. A watchful eye will be cast on how potential agreements may benefit or hinder global trade routes and resource allocation.

Comments are closed.