$ETH $FUEL $SOL

#Ethereum #DeFi #SparkProtocol #FuelNetwork #blockchain #cryptotrading #DEX #CEX #orderbook #decentralization #scalability #cryptoinnovation

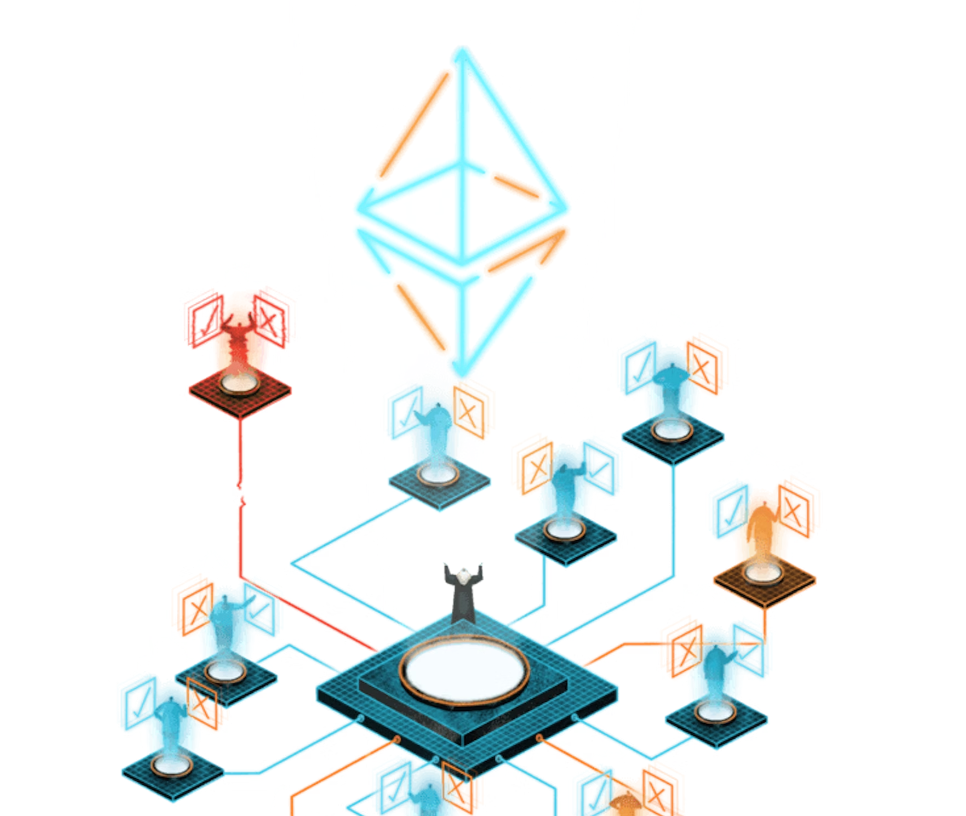

Spark, a decentralized trading protocol, has made headlines in the crypto community by launching the first fully on-chain order book within the Ethereum ecosystem, courtesy of the Fuel Network. This innovative approach aims to address several critical limitations faced by the Decentralized Finance (DeFi) sector, providing a more efficient, secure, and transparent trading experience. By minimizing the state and slashing storage requirements, Spark is set to offer expedited transactions without sacrificing security, a formidable challenge in today’s trading landscape. The introduction of on-chain order books signifies a major leap towards aligning DeFi with the sophisticated needs of institutional traders, who demand more from the sector in terms of high-frequency and algorithmic trading capabilities.

At its core, Spark’s proposition revolves around the deployment of Central Limit Order Books (CLOBs) to the Ethereum ecosystem, a feature more commonly associated with traditional stock markets. CLOBs operate by matching buyers and sellers based on price priority and time, thereby ensuring more effective price discovery and deeper liquidity. This mechanism is a stark departure from the Automated Market Makers (AMMs) and Centralized Exchanges (CEXs) that dominate the current DeFi and crypto trading paradigms, respectively. AMMs, despite their pivotal role in the rise of DeFi, fall short of catering to the advanced trading requirements of professional players. CEXs, on the other hand, have faced criticism over transparency and user control — issues Spark aims to rectify by bringing transactions entirely on-chain.

Vitali Dervoed, CEO and co-founder of Spark, has underscored the fundamental role of order books in meeting the precision, execution, and transparency requirements of both institutional and retail traders. By transitioning to an on-chain framework, Spark is redefining trading within the Ethereum space, shielding users from risks such as front-running and market manipulation, all the while allowing them to retain full control over their assets. This model not only elevates the security aspect, characteristic of self-custody, but also heralds a new era of decentralized trading that promises to bridge the gap between traditional finance mechanisms and DeFi’s novel aspirations.

The launch on the Fuel Network, an Ethereum Layer 2 solution known for its modular architecture, has provided Spark with the technological backbone to pursue its vision. Fuel Network itself has witnessed remarkable growth, with a significant uptick in Total Value Locked (TVL) shortly after its launch, signaling strong market confidence in its capabilities. As one of the inaugural dApps to debut on the Fuel Network, Spark is not just pushing the envelope in terms of what’s achievable in DeFi; it’s setting a new standard for decentralized trading platforms. The industry watches as this project spearheads a shift towards a model where transparency, efficiency, and scalability coexist, potentially steering DeFi towards broader mainstream acceptance and revolutionizing Ethereum’s trading landscape.

Comments are closed.