$DWAC $SP500 $BTC

#Trump #Election2024 #PoliticalRivals #Threats #PresidentTrump #Republicans #Democrats #CampaignFinance #StockMarket #Crypto #SP500 #MAGA

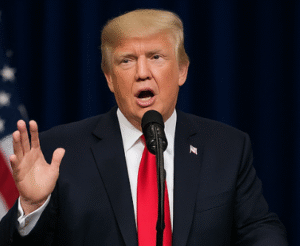

Former President Donald Trump has upped the ante on his political rhetoric, escalating his public threats against rivals as the 2024 presidential election campaign intensifies. With Trump renown for his fiery speeches and unfiltered comments, his recent remarks have focused intensively on opponents both within his own Republican Party and across the political aisle. His barbs are often aimed at prominent figures in the Democratic Party, including President Joe Biden. However, Trump hasn’t limited his critiques to the opposing party, taking sharp digs at fellow Republicans seen as potential challengers in the upcoming primaries, most notably Florida Governor Ron DeSantis.

Trump’s rhetoric in this pre-election phase is likely intended to galvanize his base while stoking a sense of urgency among his supporters. Along with name-calling and jabs, Trump has layered his speeches with promises to hold his opponents accountable if he regains office. He has suggested that some of his rivals are engaged in dishonest or legally questionable activities, fueling the narrative that his political enemies are corrupt. These sharp comments have drawn plenty of attention, both from supporters who applaud his outspokenness and critics who warn that such rhetoric could pose risks to political civility and even safety.

In turn, Trump’s escalating rhetoric appears to be moving markets, particularly any company or security linked to his political fate. An illustration of this is **Digital World Acquisition Corp** ($DWAC), the special purpose acquisition company that has been slated to merge with Trump Media & Technology Group, the organization founded by Trump to create his social media platform Truth Social. The stock has seen volatility correlated with both Trump’s popularity and his legal troubles. Some traders speculate that if Trump’s political prospects improve, $DWAC would likely grow in value. On a broader level, U.S. financial indexes, including the **S&P 500** ($SP500), may react to any instability generated in the political landscape, as uncertainty tends to impact investor sentiment negatively.

Additionally, cryptocurrencies, such as **Bitcoin** ($BTC), might serve as a speculative financial shelter during periods of heightened political drama. Over the years, Bitcoin has often been considered a hedge against political and economic instability. While Trump’s candidacy and his verbal salvos don’t directly impact crypto prices, a chaotic or highly contested election scenario could spark broader asset price fluctuations, leading some investors to flock to crypto markets as an alternative amidst institutional volatility.

Comments are closed.