$ETH $COIN $BNB $KILN

#Ethereum #ETHStaking #Blockchain #CryptoInvestment #DeFi #ProofOfStake #LiquidStaking #CryptoMarkets #DigitalAssets #CryptoNews #BlockchainTechnology #Cryptocurrency #Decentralization

A significant majority of Ethereum’s institutional investors, nearly 70%, are currently engaged in staking the cryptocurrency, utilizing the platform’s native token, ETH, for this purpose. According to a report from Blockworks Research, this activity underscores the considerable interest and investment that these firms, including investment firms and asset management companies, have in the Ethereum ecosystem. Notably, a considerable portion of these investors, over 22%, allocate more than 60% of their entire portfolio to ETH or an ETH-based liquid staking token (LST), signifying a serious commitment to the Ethereum platform. This enthusiasm for Ethereum staking has been spurred on by the network’s transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism through the Merge upgrade, which has notably altered the way Ethereum operates and the opportunities it presents for staking.

Following the Shapella upgrade in April 2023, which was a subsequent development after the Merge, Ethereum participants were provided with the option to withdraw their staked ETH, marking a significant change in the network’s operation and its appeal to investors. Initially, this led to a measured outflow, but it quickly stabilized, signaling a robust demand for ETH staking. Currently, with 28.9% of the total ETH supply staked and an overarching value exceeding $115 billion, Ethereum stands as the network with the highest dollar value of staked assets. However, as more ETH is committed to staking, the yield from staking activities has seen a proportional decrease, even though network validators can accrue additional earnings from priority transaction fees during high network usage times.

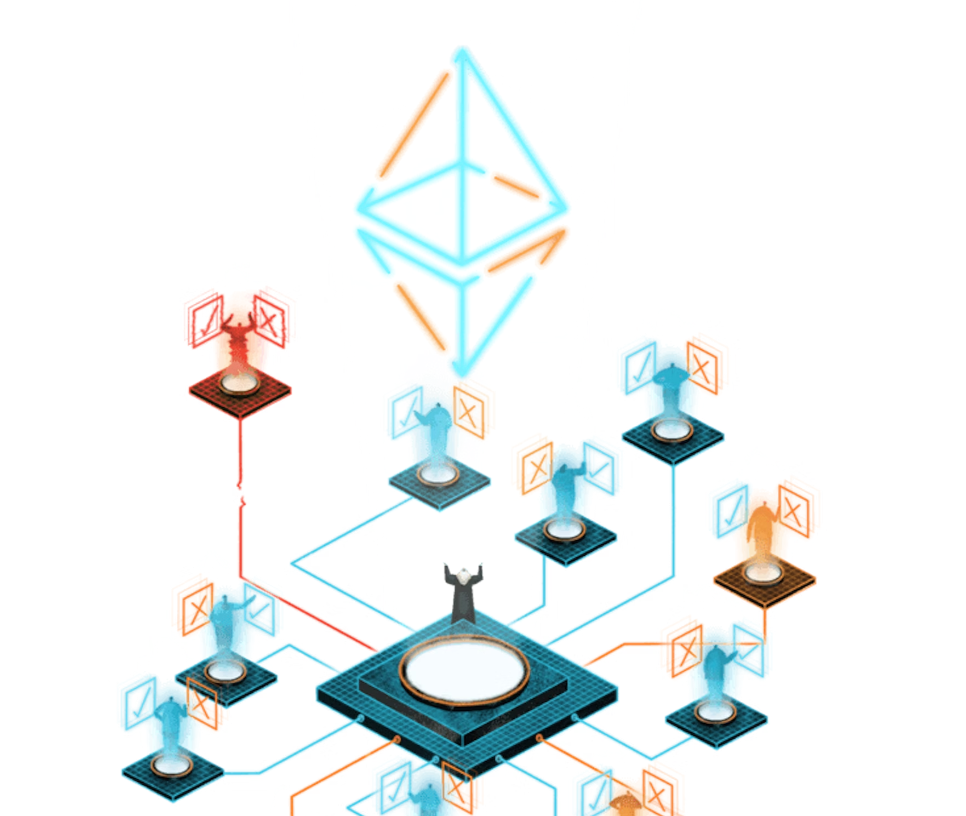

The rise in third-party staking might be attributed to the high entry barrier for solo stakers, which requires a minimum of 32 ETH (valued over $83,000 at current prices) for participation. This high threshold has led many to opt for third-party staking services, where ETH can be staked with as little as 0.1 ETH. This shift towards third-party platforms, often facilitated by centralized exchanges and liquid staking protocols, however, raises concerns about potential network centralization. Indeed, nearly half of all ETH staked through third parties is done on a single integrated platform, such as Coinbase, Binance, or Kiln, highlighting a possible centralization risk and a departure from Ethereum’s decentralized ethos.

Despite these developments, the staking landscape’s evolution appears to have had a limited impact on ETH’s price performance, especially when compared to BTC. While Ethereum has shown some price recovery following the US Federal Reserve’s decision to cut interest rates, it has underperformed against BTC over an extended period. Still, some analysts remain optimistic about ETH reclaiming its position against BTC in the forthcoming months. This scenario underscores the complex interplay between innovations in Ethereum’s operational framework, such as staking post-Merge and Shapella upgrades, and the broader market dynamics that influence cryptocurrency valuations. As the Ethereum ecosystem continues to evolve, the long-term implications for both stakers and the entire market remain a point of keen interest among investors and analysts alike.

Comments are closed.