$GLNCY $603993.SS

#MetalsTrading #LithiumMarket #CMOC #IXM #Glencore #MiningIndustry #CommoditiesTrading #ChinaEconomy #BatteryMetals #ElectricVehicles #MarketExpansion #SustainableMining

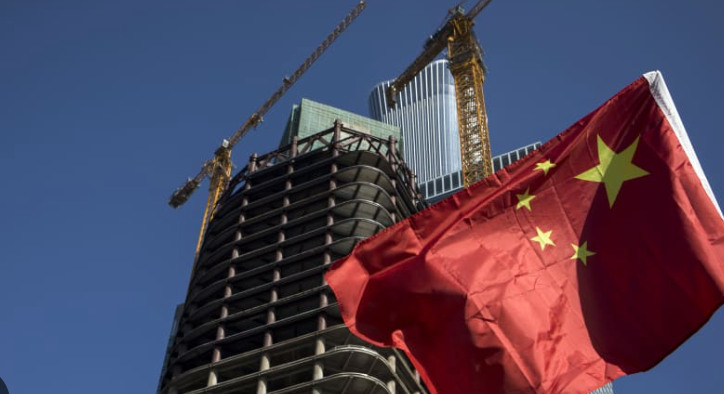

In a bold move signaling a strategic pivot within the global commodities market, IXM, a metals trader owned by China Molybdenum Co., Ltd. (CMOC), is embarking on an ambitious journey under the leadership of Chief Executive Kenny Ives. The goal is to reshape the company into China’s equivalent of Glencore, one of the world’s largest globally diversified natural resource companies. This transformation marks a significant milestone for IXM, which is already a notable player in the metals trading space, with a pronounced expansion into the rapidly growing lithium market. As electric vehicles (EVs) and renewable energy solutions gain momentum worldwide, the demand for lithium, a critical component in batteries, is expected to skyrocket, positioning IXM favorably in this burgeoning sector.

Under Ives’s stewardship, IXM is not merely diversifying its portfolio but is also strategically positioning itself to take advantage of the shifting dynamics in global trade, especially in the realm of battery metals. The move to include lithium trading in its array of offered services is a calculated decision aimed at capitalizing on the exponential growth of the electric vehicle industry. This strategic direction not only opens up new avenues of revenue for IXM but also aligns it with global efforts towards sustainability and the reduction of carbon emissions. By doing so, IXM is setting a new precedent for Chinese companies in the commodities trading space, demonstrating an adaptability and forward-thinking approach that could well redefine the industry’s landscape.

The initiative to remodel IXM aligns with broader trends observed in the global market, where there is a noticeable shift towards green energy resources and technologies. This evolution is particularly acute in China, where the government and private sector are making concerted efforts to reduce reliance on fossil fuels and enhance environmental sustainability. IXM’s foray into lithium trading, therefore, is not an isolated venture but a reflection of broader market dynamics and potential future directions of the commodities sector. With China being a pivotal market in the global EV industry, IXM’s strategic pivot could facilitate a closer alignment with national priorities of securing critical raw materials for the burgeoning sector, thus securing a robust position in the supply chain of essential commodities for green technologies.

Kenny Ives’s ambitious vision for IXM transcends the mere trading of metals. It symbolizes a transformative leap towards embracing the emerging realities of the global economy, where sustainability, technological innovation, and strategic foresight are paramount. By venturing into lithium and possibly other battery metals in the future, IXM is not just pursuing growth; it is endeavoring to become a cornerstone in the new energy economy, contributing to the development of sustainable technologies and practices. This strategic shift is indicative of a larger trend among global commodities traders who are increasingly recognizing the importance of adapting to a world where traditional energy sources are being supplemented and gradually replaced by renewable and sustainable alternatives. As such, IXM’s journey may well signal a new chapter not just for the company but for the broader industry, as it seeks to navigate the complexities and opportunities of the 21st-century marketplace.

Comments are closed.