#DonaldTrump #DeFi #WorldLibertyFinancial #cryptocurrency #blockchain #investment #financialtechnology #cryptoventure

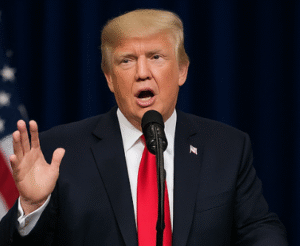

In a striking development within the DeFi (Decentralized Finance) arena, the Trump family is reportedly set to make a significant financial gain, with expectations of a $540 million payout from their latest venture, World Liberty Financial. This move marks a substantial stride into the cryptocurrency space by one of the most high-profile families globally, igniting a mix of excitement and skepticism about the venture’s implications for the DeFi landscape and the broader financial ecosystem. As the news unfolds, the crypto community and investors alike are keenly watching the potential impact of this venture on market dynamics and the regulatory landscape of decentralized finance.

World Liberty Financial, the DeFi project in question, represents a bold step by the Trump family into a sector known for its innovative approach to finance, leveraging blockchain technology to offer financial services without the need for traditional intermediaries like banks. This venture is emblematic of the growing trend among high-net-worth individuals and institutional investors to diversify into cryptocurrency and blockchain ventures, seeking to capitalize on the explosive growth and transformative potential these technologies offer. However, the involvement of a family as influential as the Trumps raises questions about the regulatory attention and scrutiny the project might attract, as well as the broader market implications of such mainstream acceptance of DeFi projects.

Critics and proponents of the venture are divided over its potential risks and rewards. On one hand, there is optimism that the Trump family’s involvement could bring increased legitimacy and adoption to DeFi, encouraging more conservative investors to take the plunge into cryptocurrency investments. On the other hand, concerns abound regarding the volatility and regulatory uncertainties inherent in DeFi, coupled with the polarizing nature of the Trump brand, which could potentially draw heightened scrutiny from regulators and policymakers. The debate hinges on whether the project will pave the way for greater innovation and financial democratization, or if it will lead to increased regulatory challenges and market volatility.

The projected $540 million payout from World Liberty Financial underscores the lucrative potential of DeFi ventures, highlighting the substantial rewards that await those willing to navigate the complex and rapidly evolving cryptocurrency landscape. As the project unfolds, its development will likely serve as a case study for the integration of traditional financial powerhouses with the nascent world of blockchain and DeFi. Observers will be particularly attentive to how the venture addresses common DeFi challenges such as security, scalability, and compliance, which could set precedents for future projects. Ultimately, the success or failure of the Trump family’s foray into DeFi will offer valuable insights into the viability of bridging traditional finance with the revolutionary possibilities offered by decentralized financial technologies.

Comments are closed.