#USCongress #CryptoRegulation #SAB121 #BidenVeto #DigitalAssets #FinancialRegulations #CryptoPolitics #Blockchain

The political landscape in the United States is bracing for a significant vote next week, a development that reveals the intricate relationship between politics, finance, and the burgeoning field of digital assets. Lawmakers are set to cast their votes on H.J. Res. 109, a resolution aimed at overturning President Joe Biden’s earlier veto of a bill concerning the Securities and Exchange Commission’s Staff Accounting Bulletin 121 (SAB 121). This bulletin has been at the heart of heated debates as it mandates financial institutions to include their customers’ digital assets in their balance sheets. Critics argue this regulation could potentially alienate digital assets from the U.S. financial system, thus stifling innovation and growth within this nascent sector.

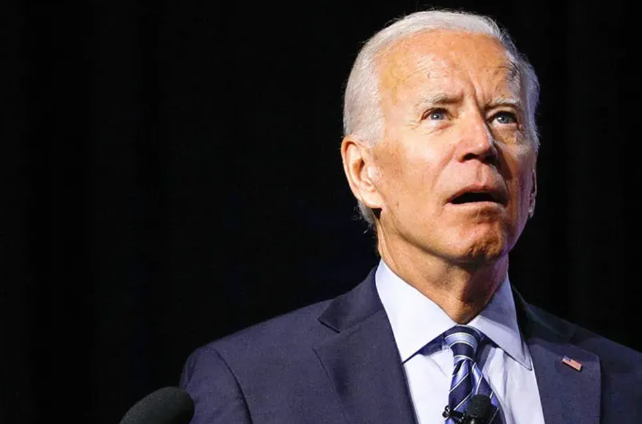

President Biden’s veto in May underscored his administration’s commitment to a stringent oversight regime over financial activities, particularly those involving digital assets. His decision was met with varied reactions from the broader financial and tech communities, which have been closely watching the government’s moves in the crypto space. Overturning such a presidential veto requires a formidable two-thirds majority in both the House and Senate—a tall order that speaks to the significance of the issue and the challenge it poses. However, Alexander Grieve from venture capital firm Paradigm notes the industry’s “growing political awareness,” suggesting a glimmer of possibility that the veto could indeed be overridden.

The crypto industry’s involvement in political processes has increasingly come into the spotlight, especially as companies such as Coinbase and Ripple begin to throw their weight behind crypto-focused political action committees (PACs) like Fairshake. This investment in political advocacy is part of a broader strategy to shape a regulatory environment that’s favorable to digital currencies and blockchain technologies. The surprising move by Multicoin Capital to donate up to $1 million in Solana to support pro-crypto Republican lawmakers further exemplifies the crypto sector’s intent to leverage political contributions to influence policies. Such activities mark a pivotal moment in the intersection of politics and finance, suggesting a future where digital asset regulation becomes a central issue in election cycles.

As the U.S. approaches another election, the stance of its leaders on crypto regulation remains a staple topic of discussion. With President Biden and former President Donald Trump courting the crypto investor base with differing visions for the industry’s future, the outcome of these political maneuvers could significantly shape the regulatory landscape facing digital assets. Amid this political tug-of-war, the forthcoming vote on SAB 121 is not just about a single SEC bulletin; it’s a bellwether for the broader debate on the role of digital assets in the U.S. economy and beyond.

Comments are closed.