#USCentralBank #FinanceNews #InterestRates #EconomicGrowth #MonetaryPolicy #InflationControl #BorrowingCosts #EconomicOptimism

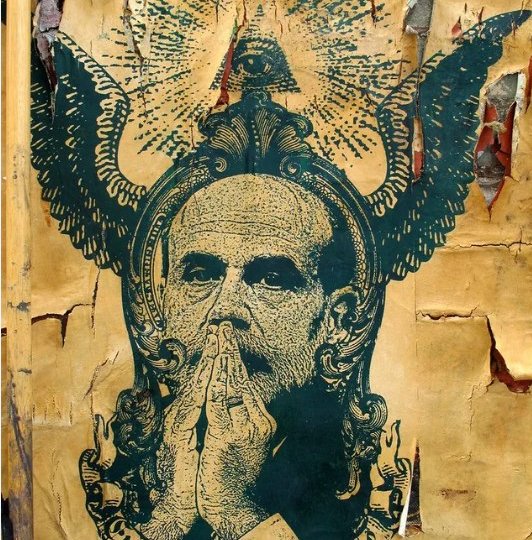

In a recent statement from the chair of the United States Central Bank, there was a significant hint that could uplift the financial markets and the broader economy: the possibility of a reduction in borrowing costs within the forthcoming months. This development comes as a much-needed breather for businesses and consumers alike, who have been grappling with the weight of high borrowing costs, making both investment and spending decisions increasingly challenging.

The Central Bank’s hint towards lower borrowing rates is seen as a strategic move to foster economic growth and stability. By potentially lowering the interest rates, the bank aims to make borrowing cheaper for individuals and businesses. This, in turn, is likely to encourage spending and investment, thereby stimulating economic activity. The decision to consider a reduction in borrowing costs reflects the bank’s confidence in the economic outlook and its commitment to maintaining inflation within target levels. Moreover, it showcases the willingness of the central bank to adjust its monetary policy in response to evolving economic conditions, aiming to balance the growth-inflation equation carefully.

However, this optimistic scenario comes with its considerations. Lower borrowing costs, while stimulating economic activity, could also risk overheating the economy if not managed carefully, leading to higher inflation. The central bank’s approach will therefore need to be meticulously planned, ensuring that any adjustment to interest rates supports long-term economic sustainability rather than short-term gains. The central bank’s stance has been widely anticipated by markets, with investors and economists closely monitoring upcoming meetings and statements for further details on the timing and magnitude of any potential rate adjustments. This cautious optimism among stakeholders underscores the delicate balance the central bank navigates in steering the world’s largest economy through uncertain times.

Comments are closed.