#GoldPrices #InflationData #FederalReserve #EconomicTrends #MarketUpdate #WeeklyRise #USInflation #FinancialMarkets

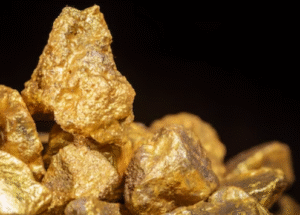

Gold prices experienced a noticeable firming, hovering close to their highest levels in a month on Friday. This positive momentum positioned gold for an upward trajectory for the second consecutive week. This development comes in the wake of freshly released data, which indicated a gradual easing in U.S. inflation rates. Such statistical revelations have a profound impact on gold prices since they directly affect the value of the currency and, consequently, the demand for gold as a hedge against inflation.

The market’s attention has now shifted towards upcoming comments from various Federal Reserve officials. The remarks from these officials are highly anticipated, as they could provide further insights into the future monetary policy direction, potentially influencing the economic landscape. The Federal Reserve’s stance on interest rates and inflation management plays a critical role in shaping market expectations and investor strategies. As traders and investors parse through the nuances of the data and await official comments, the movements in gold prices underscore the interconnectedness of monetary policy, inflation data, and investment markets.

Comments are closed.