#BerkshireHathaway #WarrenBuffett #SiriusXM #Investing #StockPortfolio #SatelliteRadio #FinancialMarkets #OddChoices

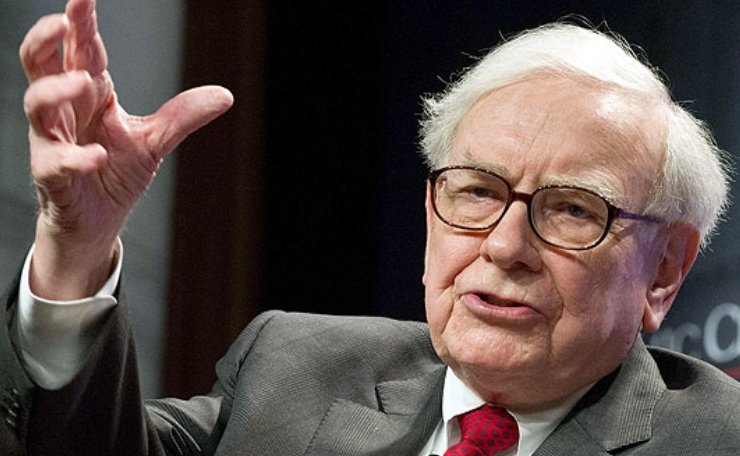

Warren Buffett’s Berkshire Hathaway, a conglomerate with a diverse portfolio of investments, is renowned for its strategic placement in the financial markets. Among its array of stocks that span across various sectors, Sirius XM Holdings has emerged as a peculiar inclusion that has caught the attention of many investors. Known for its satellite radio services, Sirius XM represents an unconventional choice for Buffett, who traditionally opts for companies with a clear competitive advantage and strong cash flows. The presence of Sirius XM in Berkshire Hathaway’s portfolio raises intrigue among market watchers, given Buffett’s historical investment philosophy which typically leans towards more predictable, less volatile sectors.

The decision to invest in Sirius XM, a company that operates in the highly competitive and rapidly changing media landscape, signifies a potential shift or broadening in Berkshire Hathaway’s investment approach. This move has sparked discussions regarding the future direction of Buffett’s investment strategies and what this could mean for the performance of Berkshire Hathaway’s portfolio. Investors and analysts alike are keenly observing how this stake in Sirius XM will unfold, pondering whether Buffett sees a unique value in the satellite radio operator that aligns with his long-term investment principles. Moreover, it prompts questions about how Buffett and his team are navigating the challenges and opportunities presented by technological advancements and changing consumer preferences in the media sector.

Image: https://weeklyfinancenews.online/wp-content/uploads/2023/09/buffet-2.jpg

Comments are closed.