#MetalsPrices #CommoditiesTrading #MarketCatalysts #PublicHoliday #ChinaEconomy #TradingVolume #CommodityMarket #EconomicIndicators

On Wednesday, the prices of metals experienced minimal fluctuations, remaining within a tight trading range. This was observed as traders navigated through a period marked by an absence of significant market-moving events and a palpable dip in trading activity. The upcoming extended public holiday in China, the world’s leading consumer of metals, was identified as a key factor contributing to the subdued trading atmosphere. Traders seemed to be treading cautiously, possibly awaiting clearer signals or developments that could provide direction to the market.

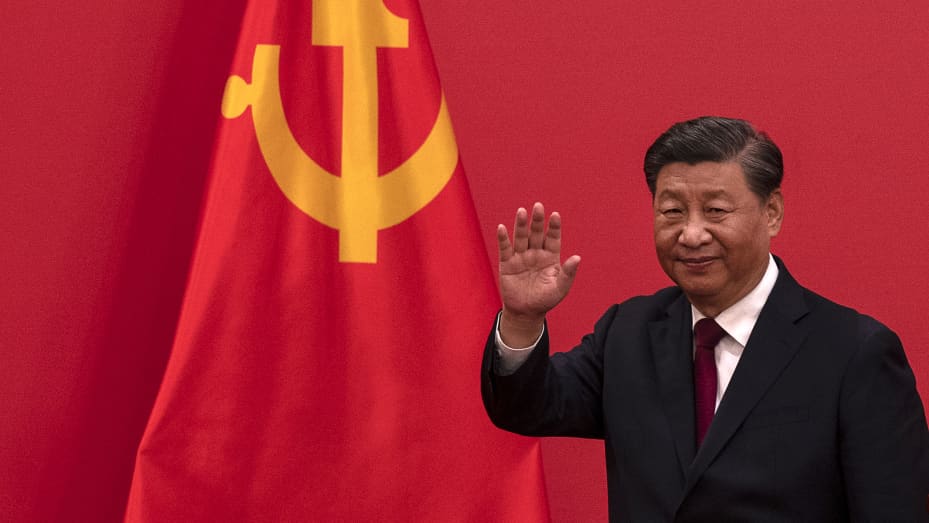

Given China’s pivotal role in the global metals market, its public holidays can indeed have far-reaching impacts on trading volumes and price movements. The anticipation of reduced trading activity during this period likely led to a wait-and-see approach among investors and traders. This scenario underscores the intricate connection between global economic events and commodity markets, where geopolitical and economic indicators can significantly sway trading decisions. As the holiday period approaches, market participants might remain vigilant, ready to adjust their strategies based on the emerging economic data post-holiday or any unforeseen market catalysts.

Image: https://weeklyfinancenews.online/wp-content/uploads/2023/08/china5.jpeg

Comments are closed.