#IndianStockMarket #BenchmarkIndexes #MarketTrends #ITStocks #USInflation #FederalReserve #FinancialPolicy #StockMarketUpdates

India’s key market indicators exhibited a lackluster performance on Wednesday as a decline in Information Technology (IT) stocks exerted pressure on the indexes. This slide in the IT sector came as a response to the looming apprehensions regarding inflation levels in the U.S, reintroducing concerns the global financial market has been grappling with in recent times. The anticipation of the decision from the Federal Reserve on its policy further augmented the sense of uncertainty, tempering the market’s enthusiasm and driving a more cautious stance across the board.

These global macroeconomic factors have critical implications on the Indian stock market as international investors gauge the landscape for their investments. The critical decision on U.S policy by the Federal Reserve amplifies this tension, as it holds major sway in determining the directional movement of global markets. The impact was particularly felt in the IT sector, causing the stocks to drop and leave its mark on the benchmarks. However, deeper insights and further policy details will provide a clearer picture of how the market is likely to swing in the coming days.

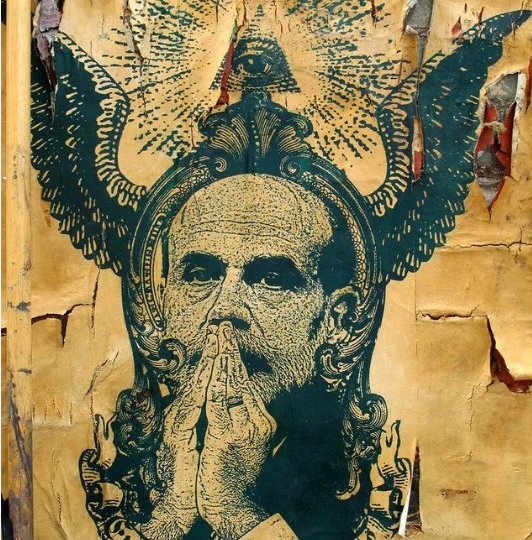

Image: https://weeklyfinancenews.online/wp-content/uploads/2023/08/fed1.jpg

Comments are closed.