the recent conflict. The market sentiment may also be influenced by the latest economic data from China, which showed a better-than-expected growth rate in the first quarter.

Investors are closely monitoring the situation in the Middle East as the Israel-Hamas conflict escalates. The conflict has raised concerns about potential geopolitical risks and the impact on global markets. As U.S. President Joe Biden prepares for his Middle East trip, tensions remain high, with both sides exchanging accusations and showing no signs of an immediate ceasefire.

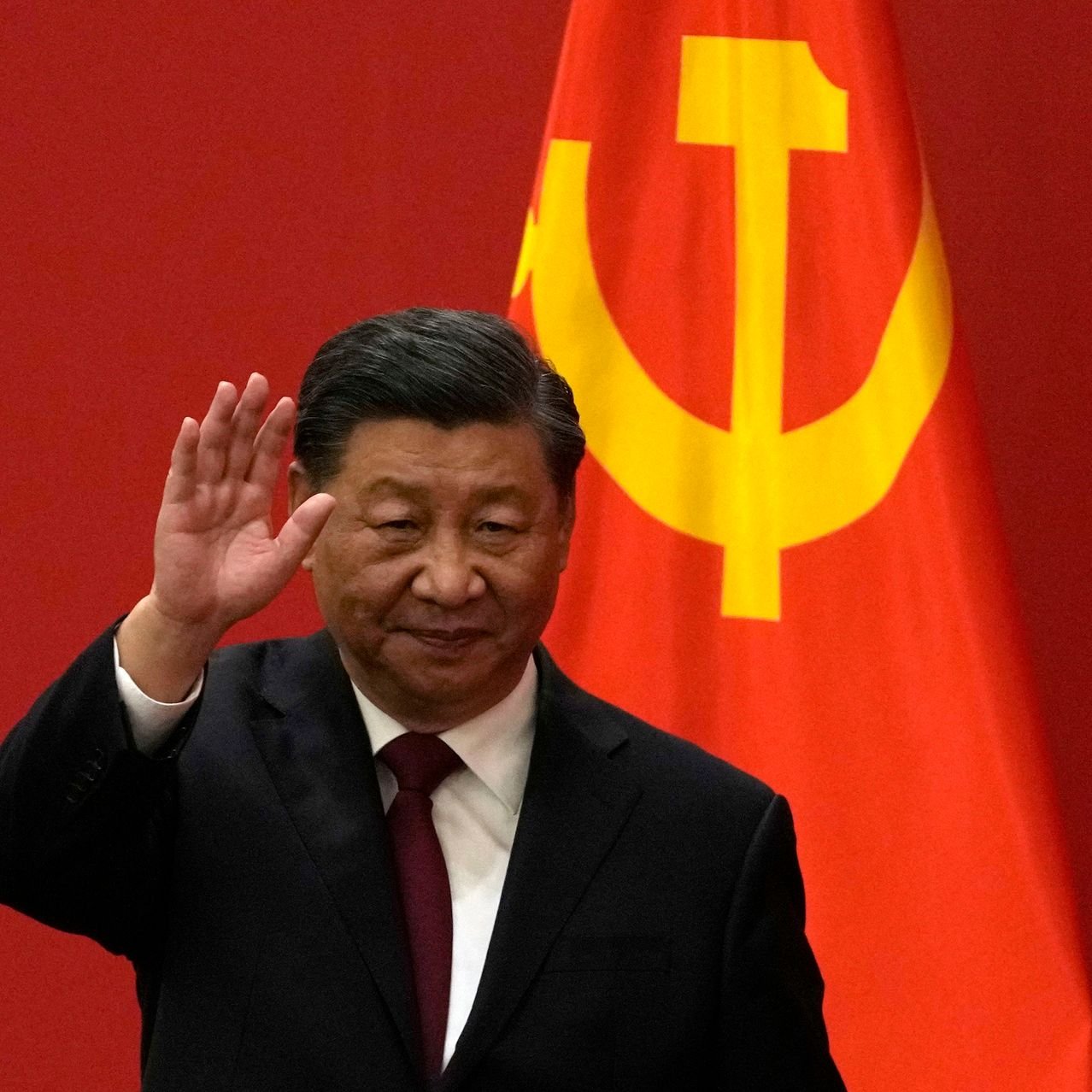

Meanwhile, positive economic data from China could provide some support to the European market. The latest figures revealed that China’s economy grew by 18.3% in the first quarter, beating expectations. This signifies a strong recovery and indicates increased global demand for Chinese goods and services. However, investors will continue to keep an eye on any potential signs of tightening measures by the Chinese government to control the surging growth.

#Europeanmarkets #MiddleEastconflict #Israel #Hamas #geopoliticalrisks #globalmarkets #JoeBiden #Chinadata #economicrecovery

Image: https://weeklyfinancenews.online/wp-content/uploads/2023/08/china4.jpeg

Comments are closed.