Last updated on October 9, 2023

The economies of emerging countries are currently experiencing significant challenges from various sources. One of these challenges is the recent selloff in U.S. Treasuries, which has caused instability and uncertainty in these economies. This selloff has led to a decrease in demand for emerging market assets, as investors choose to shift their focus to safer investments.

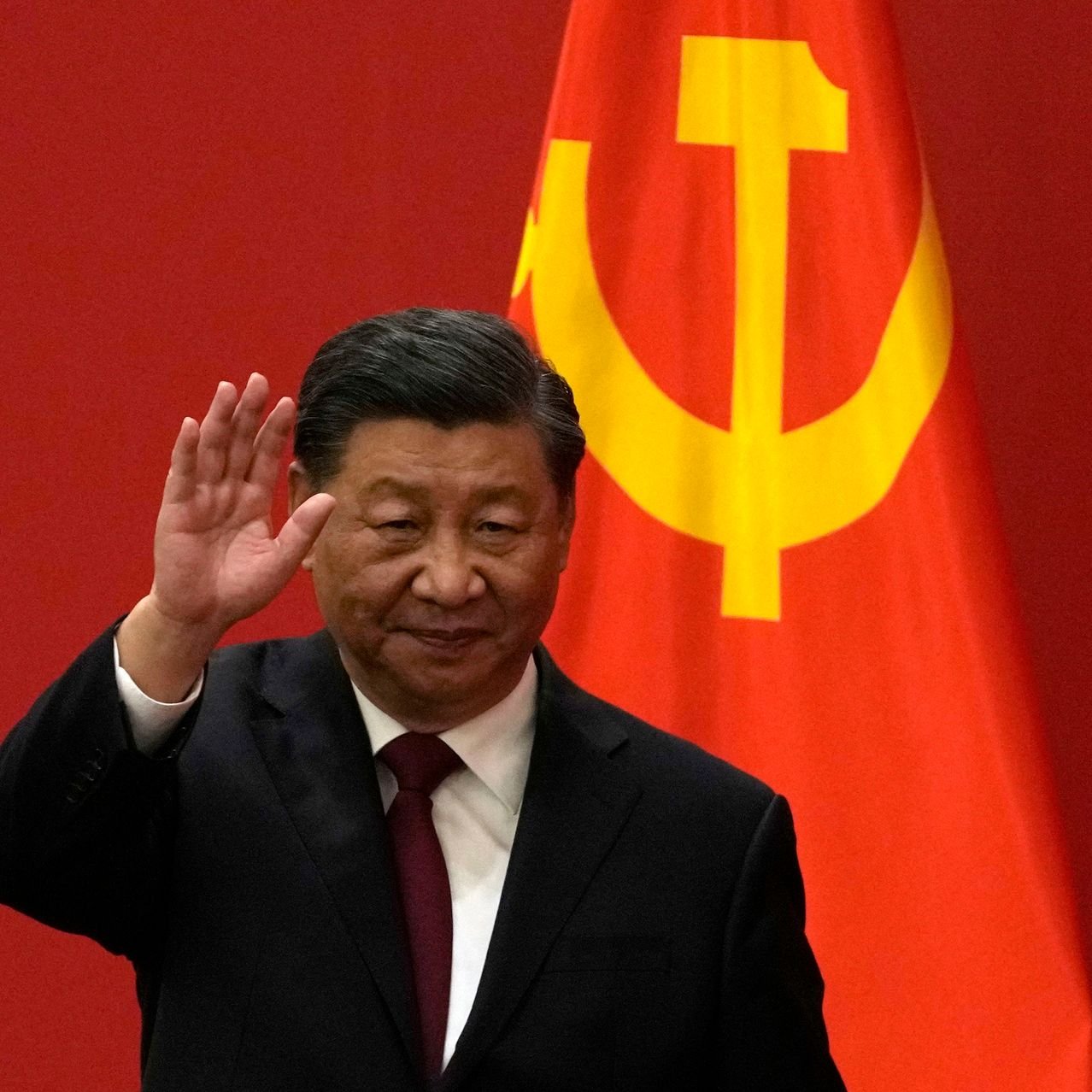

Furthermore, China’s slowing economy is also posing a threat to emerging economies. China, being a major trading partner for many emerging countries, plays a critical role in their economic growth. However, as China’s economy slows down, it has a ripple effect on these emerging economies, leading to decreased export opportunities and reduced overall economic activity.

To add to these challenges, there are also concerns that the Federal Reserve might not be done with its rate hike cycle. This uncertainty surrounding the future actions of the Federal Reserve creates additional headwinds for emerging economies. Higher interest rates in the United States often lead to capital outflows from emerging markets, making it even more difficult for these economies to achieve stability and growth.

Overall, emerging economies are contending with multiple obstacles, including the selloff in U.S. Treasuries, China’s economic slowdown, and the potential for further rate hikes by the Federal Reserve. Navigating through these headwinds requires careful planning and strategic measures to ensure stability and promote sustainable growth.

#EmergingEconomies #EconomicChallenges #US_Treasuries #ChinaEconomy #FederalReserve #RateHikeCycle #GlobalUncertainty #EconomicInstability

Image: https://weeklyfinancenews.online/wp-content/uploads/2023/08/china4.jpeg

Comments are closed.