As Saudi Arabia reduces its oil supply, a weak currency provides an incentive for the country to boost its oil exports. The recent decline in the value of the Saudi Arabian riyal has made its oil exports more affordable and attractive to international buyers. This combination of reduced supply and a weak currency could help Saudi Arabia maintain its position as one of the top oil exporters in the world.

A weak currency makes a country’s exports cheaper for buyers from other nations. With the decline in the value of the Saudi Arabian riyal, oil exports from the country have become more affordable and competitive in the global market. This presents an opportunity for Saudi Arabia to offset revenue losses that may result from reducing its oil supply.

By increasing its oil exports, Saudi Arabia can take advantage of the weak currency and potentially mitigate the impact of reduced supply on its economy. However, the success of this strategy will depend on various factors, including global demand for oil and the competitive landscape in the energy market. Nonetheless, a weak currency offers Saudi Arabia an incentive to boost its oil exports and maintain its position as a major player in the global oil industry.

Hashtags: #SaudiArabia #oilexports #weakcurrency #energyindustry

SEO Keywords: Saudi Arabia, oil exports, weak currency, reduce supply, global market, competitive, energy industry

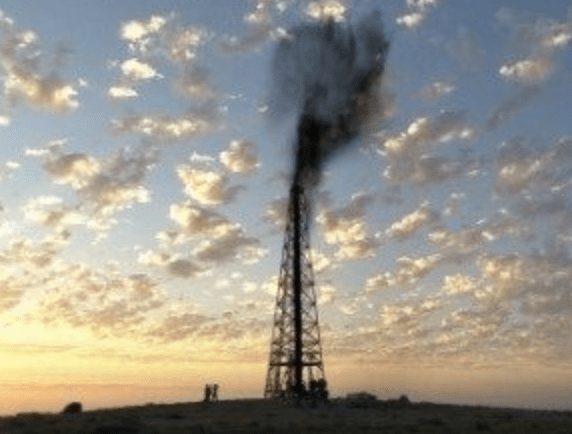

Image: https://i0.wp.com/weeklyfinancenews.online/wp-content/uploads/2023/08/oil3.png

Comments are closed.