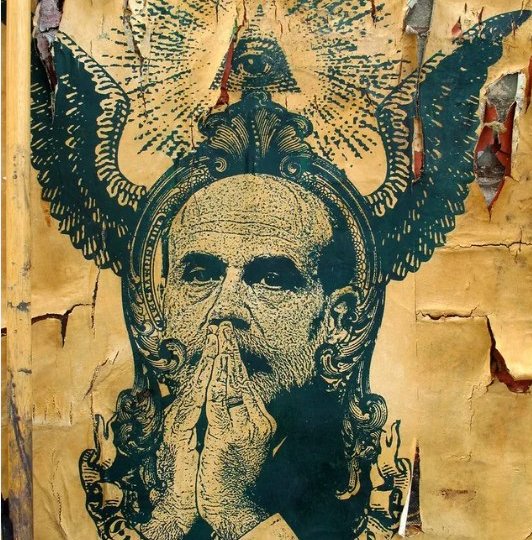

When it comes to discussing if Berkshire can outperform, it is essential to consider several factors. Berkshire Hathaway is a multinational conglomerate holding company founded by Warren Buffett. Known for its long-term investing strategies and diverse portfolio, Berkshire Hathaway has been a dominant force in the investment world for decades.

To evaluate whether Berkshire can continue to outperform, one must examine its investment philosophy and track record. Buffett’s value investing approach focuses on companies with strong fundamentals, competitive advantages, and undervalued stocks. This strategy has proven successful over the years, as Berkshire Hathaway’s stock portfolio has consistently outperformed the market.

Another crucial factor in determining if Berkshire can outperform is the leadership and management of the company. Buffett’s ability to identify lucrative investment opportunities and make sound financial decisions has been a key driver of Berkshire Hathaway’s success. Additionally, the conglomerate’s decentralized structure allows its subsidiaries to operate independently, fostering efficiency and resilience.

In conclusion, while nothing is guaranteed in the world of investing, Berkshire Hathaway’s history and investment philosophy suggest that it has the potential to outperform in the future. However, investors should always conduct thorough research and consider their own financial goals and risk tolerance before making any investment decisions.

Hashtags: #BerkshireHathaway #Investing #WarrenBuffett #ValueInvesting #StockPortfolio #FinancialDecisions

SEO Keywords: Berkshire Hathaway, outperform, investment philosophy, track record, leadership, management, decentralized structure, investing, Warren Buffett, stock portfolio

Image: https://weeklyfinancenews.online/wp-content/uploads/2023/08/fed1.jpg

Comments are closed.