Last updated on August 8, 2023

A recent report by the Network Contagion Research Institute (NCRI) has shed light on the significant role played by social media bots in boosting the value of cryptocurrencies associated with the now-defunct FTX exchange and its sister firm Alameda Research. The analysis examined over three million posts from 2019 to 2023 that mentioned 18 FTX-listed coins.

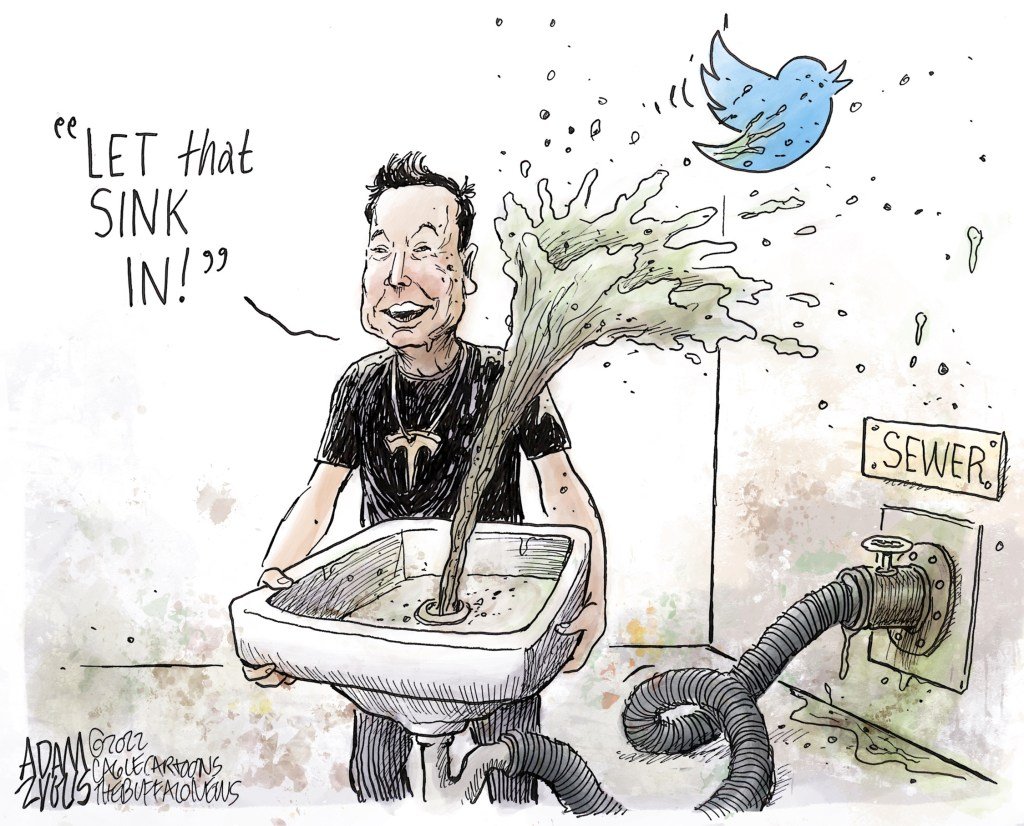

The report found that around 20% of online conversations about these cryptocurrencies were generated by bot-like accounts on the social media platform X (formerly Twitter). Remarkably, this inauthentic social media activity accurately predicted price changes for half of the FTX-associated coins analyzed.

According to the study, promotions of FTX on the platform immediately preceded surges in the values of these coins. Over time, the proportion of inauthentic posts steadily grew to comprise about 50% of total chatter. These findings suggest that manipulative tactics were employed to artificially enhance market sentiment after the coins were listed on FTX.

Moreover, the report analyzed the activity surrounding newly launched crypto tokens, such as the meme coin PEPE, and identified abnormal patterns of account creation as well as predictive connections between bot posts and price fluctuations. This points to potential ongoing market manipulation through coordinated inauthentic social media activities. The study specifically found evidence of such behavior in FTX-listed coins like SPELL, IMX, GALA, RNDR, and BOBA.

The researchers at NCRI noted that bot activity appeared to increase significantly following official FTX promotions, suggesting that FTX’s promotion may have attracted this inauthentic amplification. As cryptocurrencies gain mainstream attention, the report emphasizes the need for greater transparency and oversight in cryptocurrency markets, as the manipulation through bots and fake social media accounts poses significant risks to investors and financial stability.

The report by NCRI sheds light on the crucial role that social media played in both the rise and fall of FTX, indicating that the empire heavily relied on inauthentic online engagement to support its less valuable assets. This reflects a “bot-driven gold rush” reminiscent of pump-and-dump schemes.

In conclusion, the report by NCRI highlights the influence of X bots and their impact on FTX-listed crypto assets. It raises concerns about the potential manipulation of cryptocurrency markets and emphasizes the importance of transparency and oversight for maintaining investor trust and market stability.

#socialmediabots #cryptoassets #FTXexchange #AlamedaResearch #NCRI #manipulation #marketmanipulation #cryptocurrency #marketvolatility #investorsafety #financialstability #transparency #cryptocurrencymarkets #pumpanddump #Xbots #inflationofcryptoassets #botdrivengoldrush #cryptoinvestment #cyrptotrading #faketweets #cryptoindustry #cryptonews

Image: https://weeklyfinancenews.online/wp-content/uploads/2023/08/elon1.jpeg

Comments are closed.